BTC & ETF – Why it works

From bitcoin's origins to investment options, here we help you assess the advantages and drawbacks of bitcoin ETFs vs owning directly.

Bitcoin is the world’s leading and most widely adopted cryptocurrency and the first digital currency to gain widespread global adoption.

Bitcoin was created in 2008 after the financial crisis by an unknown person, or group of people, using the pseudonym Satoshi Nakamoto. The original intention was to develop a type of money that people could instantly send to each other over the internet, without going through a bank or any other third party. The intention was to make it cheaper and quicker to transact. This is accomplished through blockchain technology.

Earlier on, there were attempts to ban digital assets such as bitcoin in certain countries. As bitcoin evolved investor interest increased and the infrastructure networks to support it progressed. Regulators and governments globally started to recognise that bitcoin and digital assets could be a technological innovation that is here to stay. Their job is to ensure that there is effective regulation to protect investors and markets.

Up until recently, investors could only invest directly in bitcoin through ‘crypto exchanges’. One of the interesting evolutions of bitcoin and its ecosystem has been around costs. Crypto exchanges have evolved and grown. They now charge costs such as conversion fees, transfer fees to/from your traditional bank account, maker/taker fees, set transaction fees, or tiered transaction fees based on trading volume. These fees may give investors pause for caution.

Another issue for those accessing bitcoin directly is storage and security risks such as ‘digital’ theft.

Many investors are also wary of past scandals and collapses involving bitcoin exchanges and intermediaries.

Recognising that investors may need professional help to navigate the complex world of cryptocurrencies, VanEck determined that ETFs could be an ideal vehicle for investors to access this asset class. Importantly, as they are managed funds, ETFs are subject to the same regulatory oversight as other ETFs.

ETFs are an efficient and low-cost way of investing in shares or other assets and have become one of the world's most popular ways to invest. They are known for their transparency and ease of trading. ETFs have also made available investment opportunities that were previously inaccessible for everyday investors. We think bitcoin is one such opportunity.

In the past, VanEck has made opportunities available to investors that they would otherwise not have had access. Founder, John C van Eck, understood that investors need a hedge in their portfolios if and when governments lose control over the money supply. When US spending was out of control in the 1960s, he launched the first gold miners share fund in the US, even though gold had been pegged against the US dollar for about 190 years. Investing in gold bullion was illegal at the time. Three years later, the peg broke.

That gold miners fund is still being managed today. Our founder’s philosophy and spirit of innovation underpins our approach to investing and many of the products we bring to market.

VanEck was one of a handful of investment managers that launched a bitcoin ETF in the US in January 2024.

These new bitcoin ETFs seek to track the price of bitcoin and are designed for those who want to invest in bitcoin via their broker or stock trading apps without the need for a ‘digital wallet’ or the need to master the complexities of trading and storing bitcoin. Investors in bitcoin ETFs also have the comfort that, like other ETFs, bitcoin ETFs are regulated.

The advantage a bitcoin ETF has over investing directly in bitcoin is that it overcomes many of the challenges noted above. With a bitcoin ETF, investors own units in the ETF, removing the need to determine where and how to store their bitcoin, as this is handled by the fund’s dedicated bitcoin custodian.

We think the custody arrangements are one of the key benefits of a bitcoin ETF, over owing bitcoin and managing directly. ETF custody provides investors institutional-grade protection of bitcoin, kept in, what is called, ‘cold storage’. This enhances security, compliance and risk controls.

Cold storage refers to storing bitcoin offline (i.e. not connected to the internet) to protect against unauthorised access and cyber threats. This contrasts with ‘hot storage’, which is online and connected to the internet.

Bitcoin held by the ETF is primarily held offline in cold storage. The ETF’s bitcoins are generally only moved to a hot wallet when a buy or sell of bitcoins is initiated. The bitcoin not making up part of the trade remain in cold storage.

For the investor, trading a bitcoin ETF may be more efficient than buying bitcoin directly. As mentioned above, because ETFs are managed investment schemes, they are subject to regulatory oversight designed to protect investors. The ETF will provide tax reporting, and as the ETF is traded via a broker there is no need for accounts with crypto exchanges. It’s important to note, however, that investing in a bitcoin ETF still involves a high degree of risk, including possible loss of all capital.

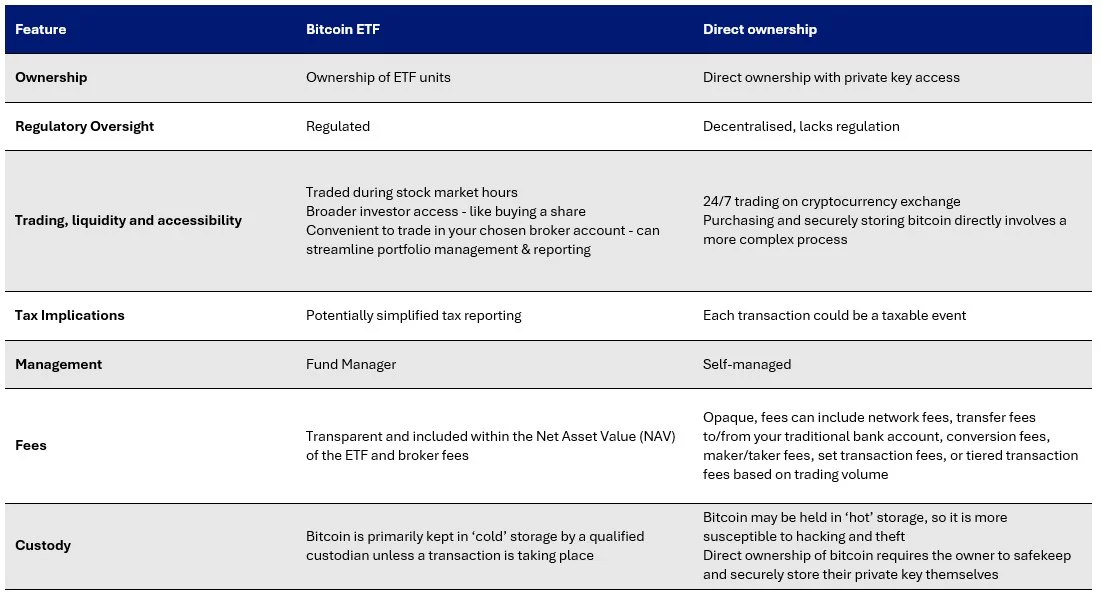

Table 1: Comparing a bitcoin ETF vs direct investment

Up until now, ASX investors have not been able to access the bitcoin ETF opportunity. Enter VanEck. We are in the final stages of preparation for the VanEck Bitcoin ETF (ASX: VBTC), which we expect to list on ASX on Thursday 20 June 2024. For those who would like to learn more, we invite you to attend our expert webinar taking place Thursday - you can register here.

Key risks: An investment in the fund involves extremely high risk and the potential for loss of all capital invested. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an invest in the fund include those associated with pricing risk, regulatory risk, custody risk, immutability risk, ASX trading time risk, concentration risk, environmental risk, currency risk, operational risk, underlying fund risk and forking risk. See the VanEck Bitcoin ETF PDS and TMD for details.

Published: 16 June 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETFs traded on the ASX. Units in VBTC are not currently available. The PDS will be available at vaneck.com.au. The Target Market Determination will be available at vaneck.com.au. You should consider whether or not any VanEck fund is appropriate for you. The level of investment risk is considered extremely high. Investors must be willing to accept a significant or total loss of their investment. See the PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.