Small caps. Big potential.

The rationale for this optimism for small companies is that when a central bank pivots from hiking to cutting it is usually in response to economic weakness. Triggering the next stage of the cycle and it is in these environments that being small and nimble has its advantages.

Small companies tend to be domestic rather than internationally focused and they also tend to be more sensitive to the macro environment, tending to underperform in the downturn and outperform in expansions.

Now, if the AFR is to be believed, investors are reassessing their portfolios and preparing for the next cycle following the anticipated slowdown, which could lead to a period of recovery.

In the past, and during this type of cycle, small caps have offered more upside than large caps because they have fallen further in the market downturn. But you have to be brave. Extra risk has always been associated with small-cap investing, but it has also long been associated with extra potential growth.

This notion is supported by academic research. In 1981, Banz* found that “smaller firms (firms with low market capitalisation) have higher risk-adjusted returns than large firms on average”.

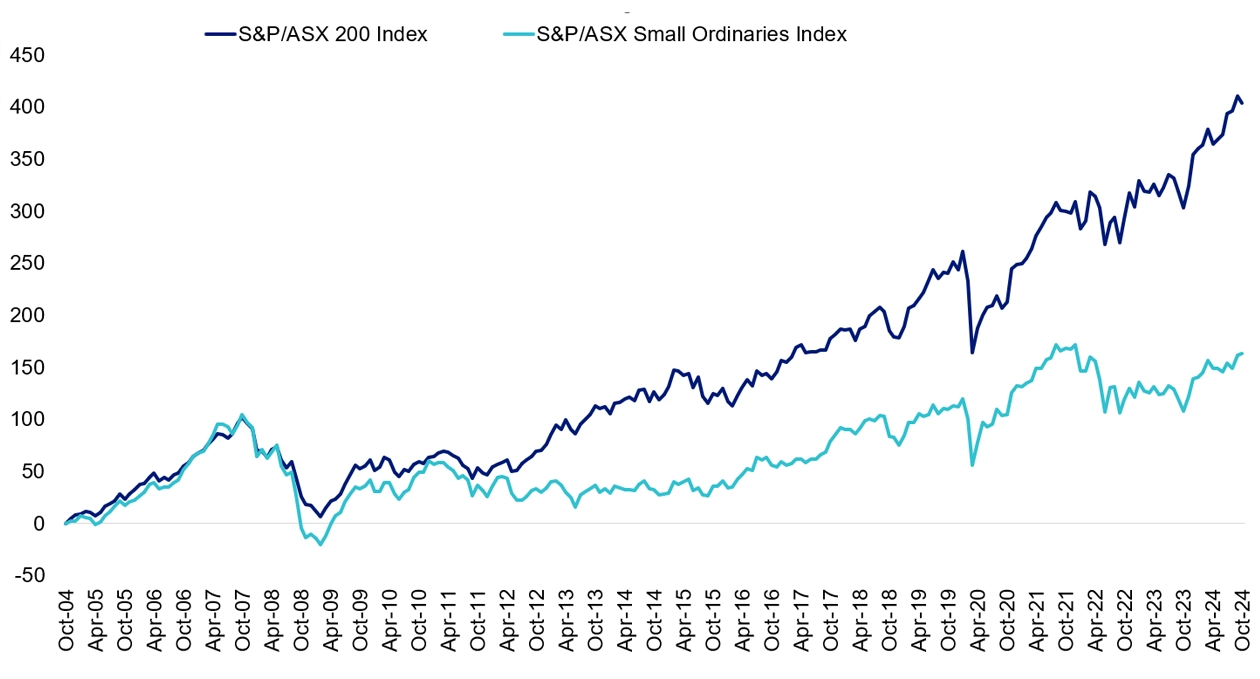

Small companies have historically presented opportunities for growth but in Australia the experience has been mixed. Not all Australian investors in small companies, have experienced what the research suggested. The market index for Australian small companies, the S&P/ASX Small Ordinaries Index (Small Ords), has delivered lower cumulative returns relative to the broader, large-cap dominated S&P/ASX 200 Index over the long term.

Chart 1: The Small Ords have underperformed its large cap counterpart

Source: Morningstar Direct, 20 years, 31 October 2004 to 31 October 2024. Past performance is not indicative of future performance. You cannot invest in an index.

This phenomenon is rare, and as part of a paper that analysed investing in global small companies, we uncovered a number of reasons why we think, Australian small companies have broadly underperformed including:

- The size of the market and size of companies are too small. The total market cap of the Small Ords is only ~$360 billion.

- Many of the companies in the Small Ords are in their infancy or start-up phasee. the extremely risky part of the business cycle.

- The Small Ords include a larger percentage of explorers and unprofitable resource companies.

In addition, the ‘smaller’ part of the Australian share market tends to not be as heavily researched, so not as much information is known about those companies, as say, the mega caps in the top 10. Therefore, the Australian small caps market is considered inefficient.

But Australians love an underdog, and that has not stopped us from seeking the growth of small companies. According to a review of Morningstar data, 12% of all money invested in Australian equity funds (ex ETFs) in Australia are invested in small companies funds (as at 30 June 2024). The attraction to active funds is understandable. But the problem for Australian investors is that, traditionally, to achieve outperformance in Australian small companies it has been either:

- time consuming and risky for direct investors; or

- costly for indirect investors in actively managed small companies funds.

Among the analysis that active small company managers undertake are a review of the growth potential of the company. They also assess profitability and cash flows. Of course they are wary of not overypaying for a company too, so look for value. This type of analysis is a growth at a reasonable price. In the industry the jargon for this is GARP.

GARP analysis has typically been the domain of active managers.

That has been changing. Now innovations in index design allow ETFs to track indices that have been created using many of the tools active managers use to assess companies. MarketGrader is one such company at the forefront of this innovation.

As a result of this index innovation, ETF issuers, such as VanEck, can track these new indices and offer ETFs to investors at a fraction of active management. Australian small companies, we think, is one such opportunity.

The VanEck Small Companies Masters ETF (MVS) now tracks MarketGrader Australia Small Cap 60 Index.

Let’s look under the hood of MVS.

The MarketGrader Australia Small Cap 60 Index assesses all companies in the universe of Australian Small Companies, and then grades all of these based on 24 fundamental indicators across four analytical categories: growth; value; profitability; and cash flow.

Chart 2: MarketGrader Research: A focus on fundamentals

Source: MarketGrader Research

This is a GARP analysis. The index includes securities that offer the best potential for ‘growth at a reasonable price’, grading securities from 0 to 100.

Companies with a score less than 40 (which would make them a ‘sell’) are excluded. The small companies remaining are then ranked by their earnings yield, to ensure only companies with strong balance sheets are included. The top 60 are selected.

The advantage of this approach, in addition to low fees and full transparency, is that because this is a rules-based strategy, no investment manager’s bias can sway the portfolio. The portfolio won’t hold onto a stock for too long because someone is in ‘love’ with it, nor will it trade because of a feeling.

This innovative approach gives investors the best of both active and passive worlds, a portfolio with the potential to outperform, but with the benefits of low costs. Otherwise known as smart beta. And as we have said before, smart beta could disrupt active managers… perhaps even in Australian Small companies.

*The relationship between return and market value of common stocks, The Journal of Financial Economics

Published: 03 November 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

MVS tracks the MarketGrader Australian Small Cap 60 Index. "MarketGrader" And “MarketGrader Australian Small Cap 60 Index” are trademarks of MarketGrader.com Corporation. MarketGrader does not sponsor, endorse, sell or promote the Fund and makes no representation regarding the advisability of investing in the Fund. The inclusion of a particular security in the Index does not reflect in any way an opinion of MarketGrader or its affiliates with respect to the investment merits of such security.