The importance of a good recovery

Fitness gurus will tell you that recovery after exercise is important. Rest, hydration and healthy food aid recovery and help to heal any tiny muscle tears and aches that form during exercise.

Because markets move so quickly, investors don’t have the luxury of rest. Markets are constantly moving, but we think recoveries are just as important.

Since ancient times, the ability to heal quicker has been revered. Prometheus had this gift and in Greek mythology, he used this to survive Zeus’ harsh punishment. A punishment much harsher than any personal trainer could give you.

The story goes that Prometheus had given humans the gift of fire. For this, Zeus punished him by tying him to a rock and having an eagle eat his liver. As Zeus knew, Prometheus’s liver would grow back when he rested overnight. He would have to relive the horror with the eagle each day. You have to hand it to mythical deity – they knew how to devise retribution.

Luckily another Greek hero, Hercules, shot the eagle and Prometheus’s survival became legend.

Surviving in markets, over the long term, we think requires investors to have a strategy that, like Prometheus, can recover quickly and show resilience when times are toughest.

Identifying these types of investments has been a focus of investors since before Benjamin Graham, Warren Buffett’s mentor, penned The Intelligent Investor in 1949. Such companies show resilience by falling less in a downturn and recovering to previous highs quicker than other companies. While it is impossible for a strategy to perform well in all markets, a strategy that is consistent and has Promethean qualities should be sought after.

A new research paper, written following the 10thanniversary of VanEck’s MSCI International Quality ETF on ASX, finds that as a factor, quality has the best risk-adjusted returns above MSCI’s global equity benchmark.

Additionally, the quality factor experienced smaller declines during market downturns and recovered more swiftly to previous highs. It is the Prometheus of factor investing.

According to the paper, which analyses the returns of six different factor approaches over the past 25 years, an allocation to the quality factor could serve investors over the long term. Around this position, other factors and sector positions could be taken depending on the expectations and risk tolerance of the investor.

When considering the different factor approaches, since the beginning of 1999, only the Global High Dividend Index has underperformed the benchmark, MSCI World Index.

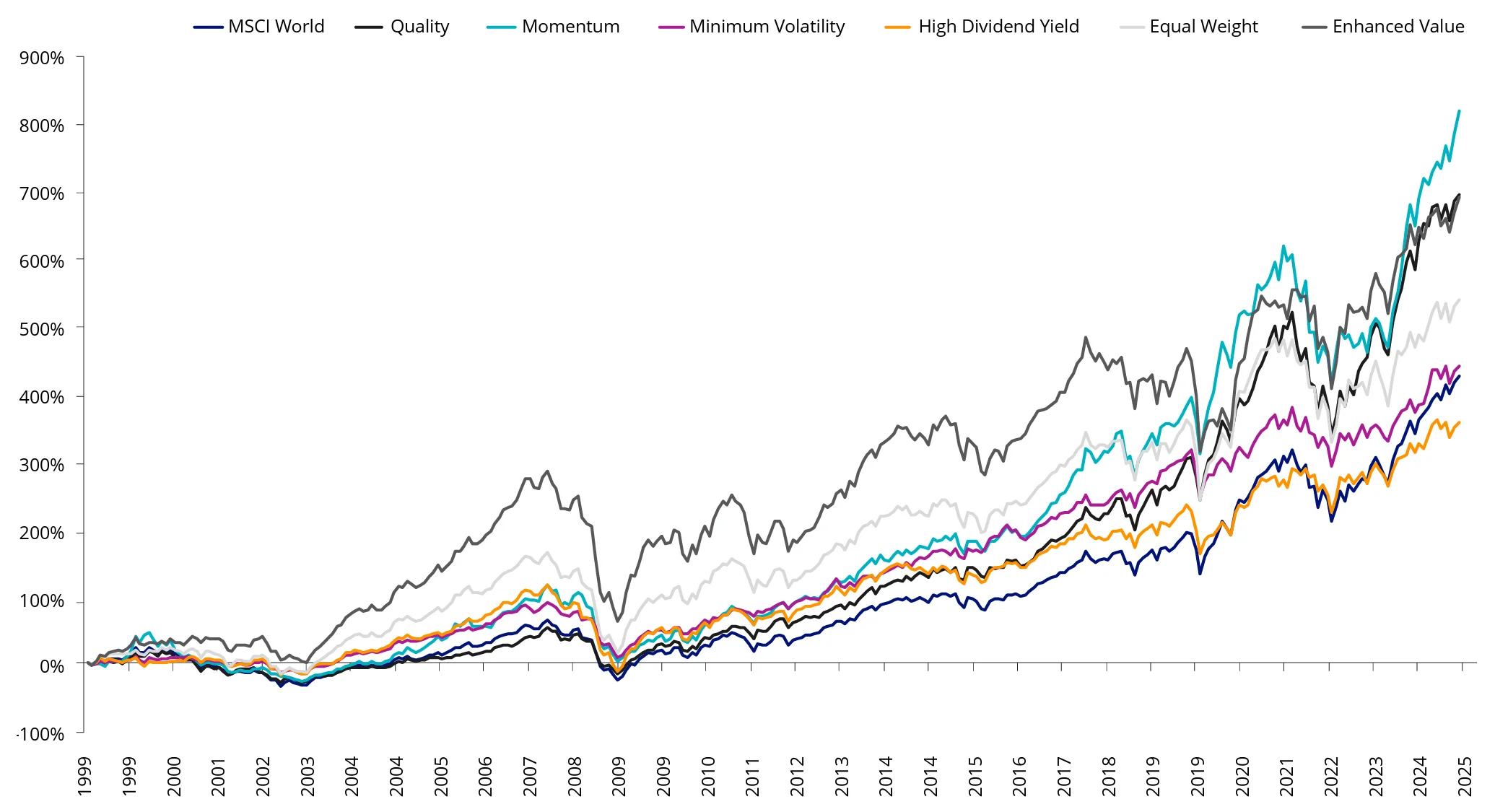

Chart 1: Cumulative performance of MSCI factor indices and MSCI World Index

Source: Bloomberg, MSCI, 1 January 1999 to 31 January 2025. Quality is MSCI World Quality Index, Momentum is MSCI World Momentum Index, Minimum Volatility is MSCI World Minimum Volatility Index, High Yield is MSCI World High Dividend Yield Index, Equal weight is MSCI World Equal Weight Index, Enhanced value is MSCI World Enhanced Value Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

You can see the investment outcomes vary over those 25-plus years. When dissecting the performance and the economic cycles over that period, the new VanEck research found that during the periods of recovery, quality, momentum and enhanced value were standouts.

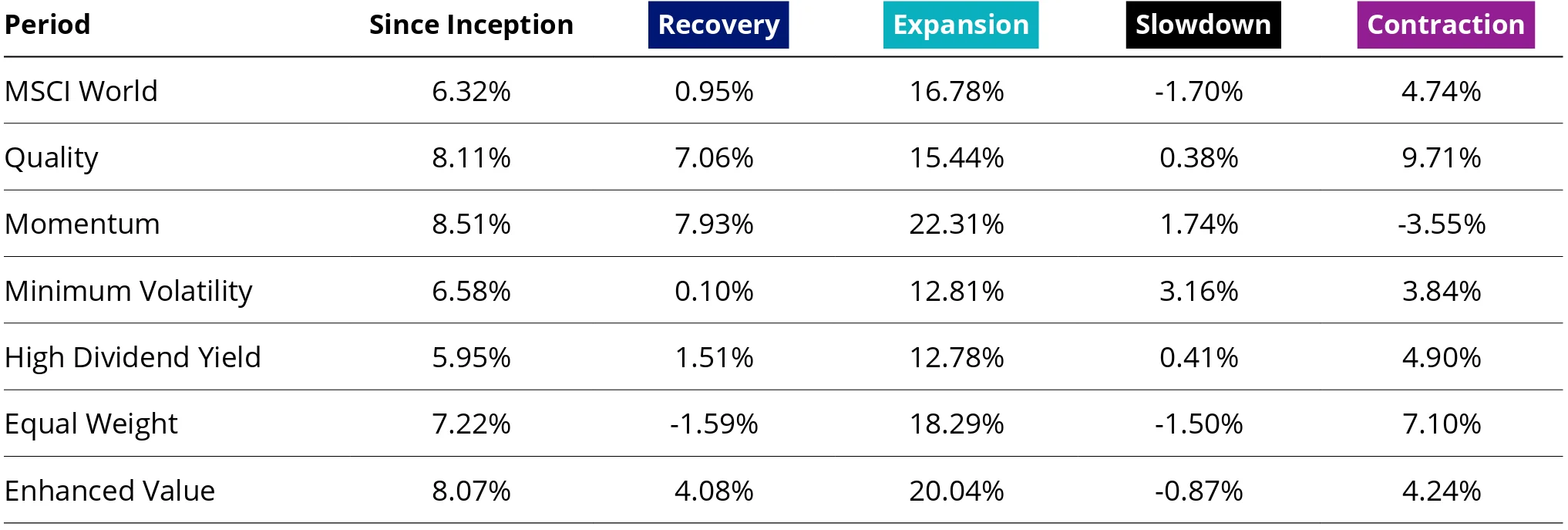

Table 1: MSCI World and factor index performance since January 1999 (p.a.)

Source: Bloomberg, MSCI, 1 January 1999 to 31 January 2025. Figures are annualised. Quality is MSCI World Quality Index, Momentum is MSCI World Momentum Index, Minimum Volatility is MSCI World Minimum Volatility Index, High Yield is MSCI World High Dividend Yield Index, Equal weight is MSCI World Equal Weight Index, Enhanced value is MSCI World Enhanced Value Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

During the most common economic environment, expansions, enhanced value and momentum performed best.

During contractions, quality and size (equal weight) were the best-performing factors. Quality also did relatively well in a slowdown, marginally behind high dividend. Momentum and minimum volatility had the strongest returns during these slowdown periods.

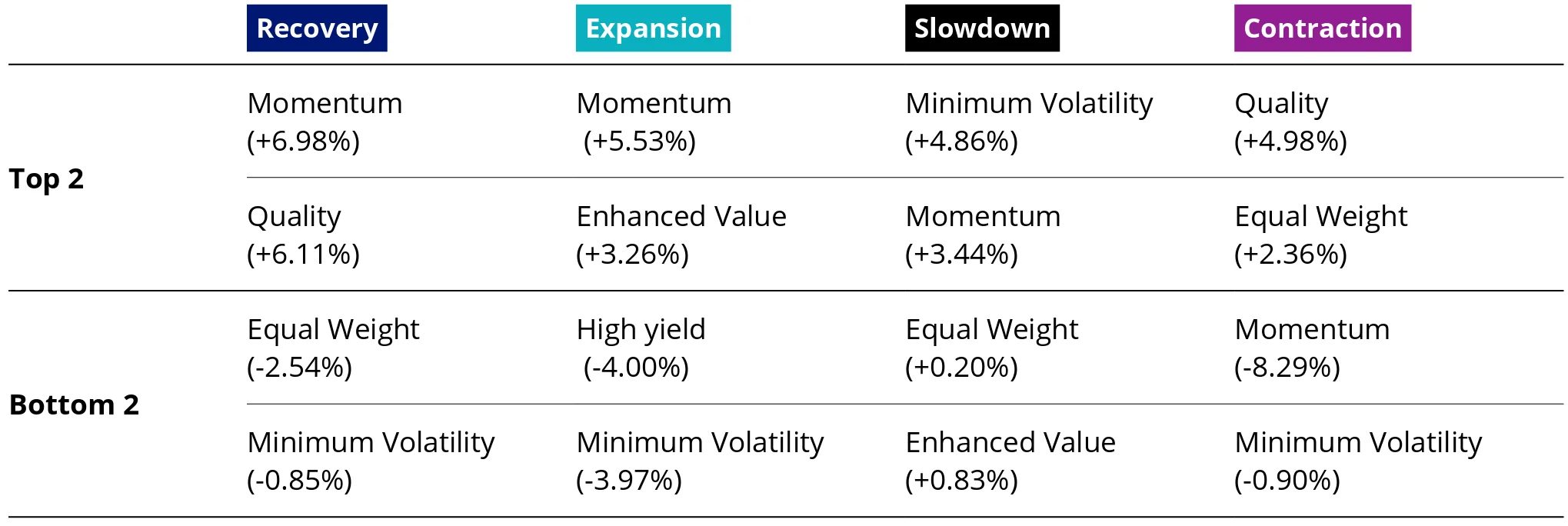

Table 2: Summarises the results by top and bottom factors (relative outperformance to MSCI World Index in brackets, p.a.)

Source: Bloomberg, MSCI, 1 January 1999 to 31 January 2025. Figures are annualised. Quality is MSCI World Quality Index, Momentum is MSCI World Momentum Index, Minimum Volatility is MSCI World Minimum Volatility Index, High Yield is MSCI World High Dividend Yield Index, Equal weight is MSCI World Equal Weight Index, Enhanced value is MSCI World Enhanced Value Index. You cannot invest in an index. Past performance is not a reliable indicator of future performance.

Over all four of the economic regimes, quality is the only factor that does not appear in the bottom two in the table above.

Momentum appears three times in the top two but also takes the winning spot (on an absolute basis) with its -8.29% p.a. underperformance during contractions. Maybe this is better described as the losing spot; either way, it highlights the volatility of the momentum factor.

Quality is the only other factor that appears in the top two more than once. The two periods when quality was not in the top two were slowdowns and expansions. It outperformed by more than 2% p.a. during a slowdown. Its relative underperformance during expansion is dwarfed by its strong relative performance during the other three economic regimes, as evidenced by its outperformance of the MSCI World Index, since 1999.

We think the results highlight the prudence of including a quality allocation to international equities.

The quality factor’s performance during economic recoveries, contractions and slowdowns exhibits the Promethean qualities Graham suggested investors should demand in The Intelligent Investor.

If only there was a way to recover, like the quality factor, from intense exercise.

Related Insights

Published: 02 March 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.