Rebuilding 60/40 portfolios with smarter alternatives

A portfolio of 60% growth assets and 40% defensive assets has long been a classic for investors who want a balanced mix of income and growth.

But the 60/40 portfolio careened off course in 2022 – raising questions about whether it should be abandoned.

We think it can come back, stronger and smarter than ever.

A portfolio of 60% growth assets and 40% defensive assets has long been a classic for investors who want a balanced mix of income and growth.

But the 60/40 portfolio careened off course in 2022 – raising questions about whether it should be abandoned.

2022 saw many asset classes, that were highly correlated on the way up post COVID-19, remain highly correlated on the way down. Investors couldn’t rely on bonds to cushion the falls of their riskier growth assets, as they had in past crises.

Prior to 2022, the worst year for Australian bonds was 1994, when the AusBond Composite Index fell 4.69%. Last calendar year it fell 9.71%.

However, last year’s performance doesn’t mean that pairing equities and bonds in a portfolio is dead, or a bad idea going forward.

What goes down can also go up

Diversifying between growth and defensive assets still makes sense; however, there are new tools available to investors than there were when the 60/40 model first emerged. Considering corporate bonds, emerging market bonds, and thinking beyond traditional ‘beta’ equity strategies can work to stabilise an overall portfolio and give a better risk-return profile over the long-term. In addition alternative asset classes such as private equity and real assets such as infrastructure can provide additional diversification benefits because of their uncorrelated returns to traditional asset classes.

The classic 60/40 portfolio

The original 60/40 portfolio was a diversified investment strategy that allocated 60% of assets to shares and 40% to bonds. The asset allocation strategy was based on the work of Nobel prize winning economist Harry Markowitz. Back in 1952, the allocation 60/40 split between shares and bonds was meant to provide a balance of growth potential and risk reduction.

In theory, the equity component of the portfolio aims to provide growth potential, while the bonds component aims to provide a source of stability and income through investments in fixed-income securities.

The approach is based on the idea that the stock market’s historical returns have been higher than bond returns, while bonds preserved capital and provided dependable income. Diversifying a portfolio between the two asset classes can help reduce overall risk.

Why 2022 was problematic for the 60/40 portfolio

For much of the past two decades returns from equities and bonds have been negatively correlated; when one goes up, the other goes down. As reported in CNBC “From 1980 through July 2022, the 60/40 portfolio delivered positive returns in 35 of 42 years. That means investors who relied on this investment mix have seen their portfolios increase in value 83% of the time. Ask any statistician and they’ll tell you that the long-term performance of the 60/40 portfolio is statistically significant and not the result of chance or luck.”

Last year the strategy didn’t work because both equity and bond markets marched lower in tandem, and the strategy failed to protect investors.

Figure 1: 2022 one of the worst years on record for a US 60/40 portfolio

Source: Goldman Sachs Investment Research Division, as of 16 November 2022. Based on performance of S&P 500 and US 10-year Treasury note, rebalanced daily.

Why 60/40 still makes sense

The reasons the 60/40 approach came into question last year have largely been erased. David Kelly, Chief Global Strategist at JP Morgan Asset Management recently told Morningstar, “Rumours of its death have been greatly exaggerated as Mark Twain would have said.” According to Kelly, what happened in 2022 was a worst case, once in a generation scenario. Both stocks and bonds went down at the same time…fixed income stopped diversifying a portfolio. So as the stock market went down, instead of the bond market going up, it went down too. And you want to have things in the portfolio that will zig as the rest of the portfolio zags.

The good news now, according to Kelly is that from a “valuation perspective” there’s now value in both shares and bonds. What happened in 2022, he said was due to a “very unusual situation of rising inflation, which seems to happen once every 40 years.”

As inflation starts to turn around and the real threat in 2023 and beyond is a recession, then that negative or low correlation between shares and bonds should be re-established according to Kelly.

Moreover, according to J.P. Morgan Asset Management, lower valuations and higher yields now mean the markets offer the best potential long term returns since 2010. “I think that this is a time where 60/40 investing looks better or more promising than it has in many, many years,” said Kelly.

Some analysts are of the view that 2023 is looking a whole lot like 2022 in reverse. The US dollar’s big surge last year has been described by some as a “huge wrecking ball ruining everything.” Now with the US dollar back around a level last seen in June 2022 Bloomberg’s Cameron Crise recently said, “that’s helping lift the 60/40 allocation mix of stocks and bonds, with a hypothetical portfolio now experiencing the best start to the year since 1987.”

Figure 2: US dollar decline

Bloomberg Dollar Index has erased half its gains from last year

Source: Bloomberg. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

Figure 3: The return of 60/40

A hypothetical 60/40 portfolio of stocks and bonds is rebounding

Source: Bloomberg. Past performance is not a reliable indicator of future performance. You cannot invest in an index.

A more sophisticated approach

The 60/40 asset allocation strategy still makes sense; however, investors have better tools available to them than Markowitz did in 1952. The advent of new technologies that enables investors to better leverage financial reports, performance data points and mathematical algorithms to optimise the diversification and risk-return profile of investment portfolios. Furthermore, private equity, global listed infrastructure, even listed property trusts are asset classes that have been created over the last 70 years.

More choices on defense

Within traditional asset classes, such as bonds, alternatives exist with markets having grown in size or been established. In 1952, alternatives such as corporate bonds or emerging market bonds would not have been as readily available as they are today.

Prior to 2022, large institutional investors were already changing the way they invested, adapting their models. From a purely Markowitz perspective, global fixed income portfolios should include emerging markets debt. While Markowitz’s calculations rely on backward looking data, forward looking fundamentals for emerging market bonds look strong. Large institutions such as the Future Fund already have this exposure.

Different and smarter approaches to growth

Our biggest superannuation and sovereign wealth funds have also invested in uncorrelated real assets such as infrastructure and real estate. They have also been a part of the rise of investing in private equity.

Private equity is investing directly in or with companies that are not publicly traded. This can include investing in start-ups, participating in buy-outs and project financing. It’s considered high risk with high reward so fits in the growth component of a diversified portfolio.

In terms of equities, the Future Fund utilises a cheaper, more passive approach. The Future Fund, in its own words, is taking passive approaches that “systematically harvests equity risk premia through exposure to factors.” That is smart beta investing.

Investors can also consider fortifying portfolios using smart beta, by incorporating factors such as value, momentum, quality and volatility into portfolios.

In 2022 smart beta came to the fore with ‘value’ being thrust back in the spotlight. Value-oriented global equity stocks outperformed growth stocks.

Now, as the Fed reinforces its commitment to fighting inflation and the fear of a hard landing and subsequent economic weakness, many investors are assessing their long-term equities approach.

A hard landing refers to a period where the economy enters a recession following a series of central bank cash rate increases and it is the most common scenario following a Fed rate rising cycle (75 per cent of US monetary policy tightening cycles since 1955 have resulted in a recession).

If the global economic recovery falters and we enter a recession, it could benefit companies that exhibit the ‘quality’ factor, as they tend to offer investors relative protection during weaker economic environments and heightened market volatility.

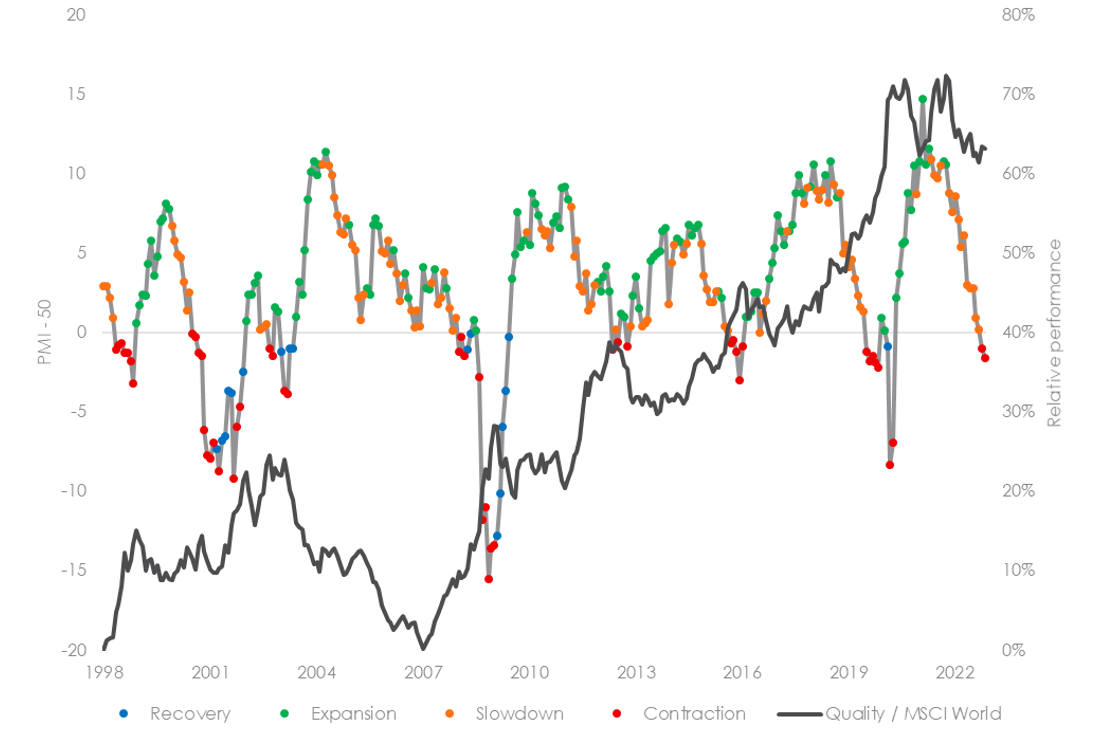

Figure 4 illustrates how quality companies typically outperform when manufacturing activity (a proxy for economic activity) decelerates (orange) and/or contracts (red). Quality is outperforming in the chart when the dark line is rising. Table 1 shows the cumulative performance of different factors during the different economic regimes.

Figure 4 – US ISM Manufacturing PMI Index and MSCI World Quality versus MSCI World performance

Table 1: Factor performance during different economic regimes

Figure 3 and table 1 source: Bloomberg. MSCI.to 31 December 2022. Past performance is not a reliable indicator of future performance. You cannot invest directly in an index. Since Inception date is common inception of indices used, 31 December 1998. Quality is MSCI World Quality Index, Momentum is MSCI World Momentum Index, Growth is MSCI World Growth Index, Enhanced Value is MSCI World Enhanced Value Index, Benchmark is MSCI World Index.

It is little wonder then why savvy investors are looking for opportunities, understanding they may not pick the bottom, but they were not going to pick the top either.

Many investors are fortifying their portfolios with quality companies while diversifying into value.

Rebuilding 60/40 portfolios with smarter alternatives

The rise of ETFs has created tools for every type of investor to create their own 60/40 diversified portfolios.

In terms of growth assets, the ASX includes opportunities in private equity, infrastructure, listed property and smart beta.

ETFs also exist that allow investors to diversify existing defensive allocations to include Australian corporate bonds, floating rate notes and subordinated debt as a part of an Australian fixed income allocation and emerging markets bonds as a part of a diversified global bond allocation.

I recently wrote, in the Australian Financial Review, “Why the new (improved) 60/40 portfolio is back in vogue”. You can read the piece - here.

Published: 03 February 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.