Transparency is a relative term

Private credit’s growth has brought both opportunity and scrutiny. Transparency and diversification remain key for investors navigating this evolving market.

Private credit was thrust into the spotlight recently when it was revealed one of the largest financial planning networks1was launching a wide-ranging review of private credit to assess whether the returns are still worth the risk.

Concerns about the sector are not new. Its risks are (or should be) well known to all who dip their toe in. For investors, the lure of private credit is higher rates of returns and potentially higher income, albeit for higher levels of risk.

On the other side of the coin, private credit provides access to capital to borrowers without some of the constraints of bank loans. This comes at a higher cost to the borrower via higher interest payments.

Private credit has been in the headlines of the financial press this year.

In late February, Australia's corporate regulator, ASIC, in response to the sector’s rapid growth and its observations, released a discussion paper titled, Australia’s evolving capital markets: A discussion paper on the dynamics between public and private markets.

In March, Oaktree founder Howard Marks wrote a memo to his investors titled Gimme Credit.

It is worthwhile considering both documents to understand the current interest in private credit.

ASIC’s paper highlights the growth in private markets, driven by factors such as the expansion of the superannuation system and the increasing prominence of private credit. While these are not bad things, the paper suggests that one of the key differences between public markets and private markets presents a potential risk for the broader economy: the lack of transparency.

Where public markets provide, according to the paper, “price discovery and liquidity, facilitating efficient valuation, pricing and capital,” private markets rely on “methodologies and judgements” that “may not always be independent”.

This opacity, potential conflicts of interest, valuation uncertainty and potential illiquidity, ASIC Chair, Joe Longo states “are the key risks I am concerned for ASIC to focus on.

“The critical point is understanding whether there is a need for intervention, whether it is for ASIC or another regulator to consider, or whether we leave the market and wholesale investors to their own devices.”

The market Howard Marks operates in, the US, also has a problem with efficient pricing and “the lack of marking to market,” and Marks discusses this in his paper. This is interesting because the US private credit market is more transparent than in Australia. However private credit in the US is less transparent than the public markets Marks uses for his comparison.

In the US, investors access private credit via Business Development Companies (BDCs). Some BDCs are listed on US exchanges like NASDAQ, NYSE and CBOE and operate similarly to the private credit LITs and LICs on ASX.

There is a big difference – additional reporting transparency.

BDCs are regulated by the Investment Company Act of 1940. A requirement is compliance with the reporting obligations applicable to publicly held operating companies.

This requirement ensures additional transparency and investor protection. Investors have access to the valuations of underlying assets and how this has been calculated. Among these are the standards used within the context of fair value accounting, that require an explanation of the assumptions and models used.

It turns out transparency is relative.

Where Marks sees opaqueness, an Australian private credit investor may see better transparency. The additional reporting is an advantage BDCs have over ASX-listed private credit LICs or LITs.

When combined with the ease of trading and transparency of an ETF, private credit is within reach of all Australian investors.

Currently, all of the companies VanEck’s Private Credit ETF (LEND) invests in are US-listed BDCs, so while there is credit risk associated with BDCs, investing in an ETF like LEND, allows investors to access the private credit market and limit single LIT/BDC credit risk and increase diversification. On a look-through basis based on LEND’s current constituents, this is 4,556 borrowers and 5,920 underlying loans (you can see how much information the additional reporting can garner).

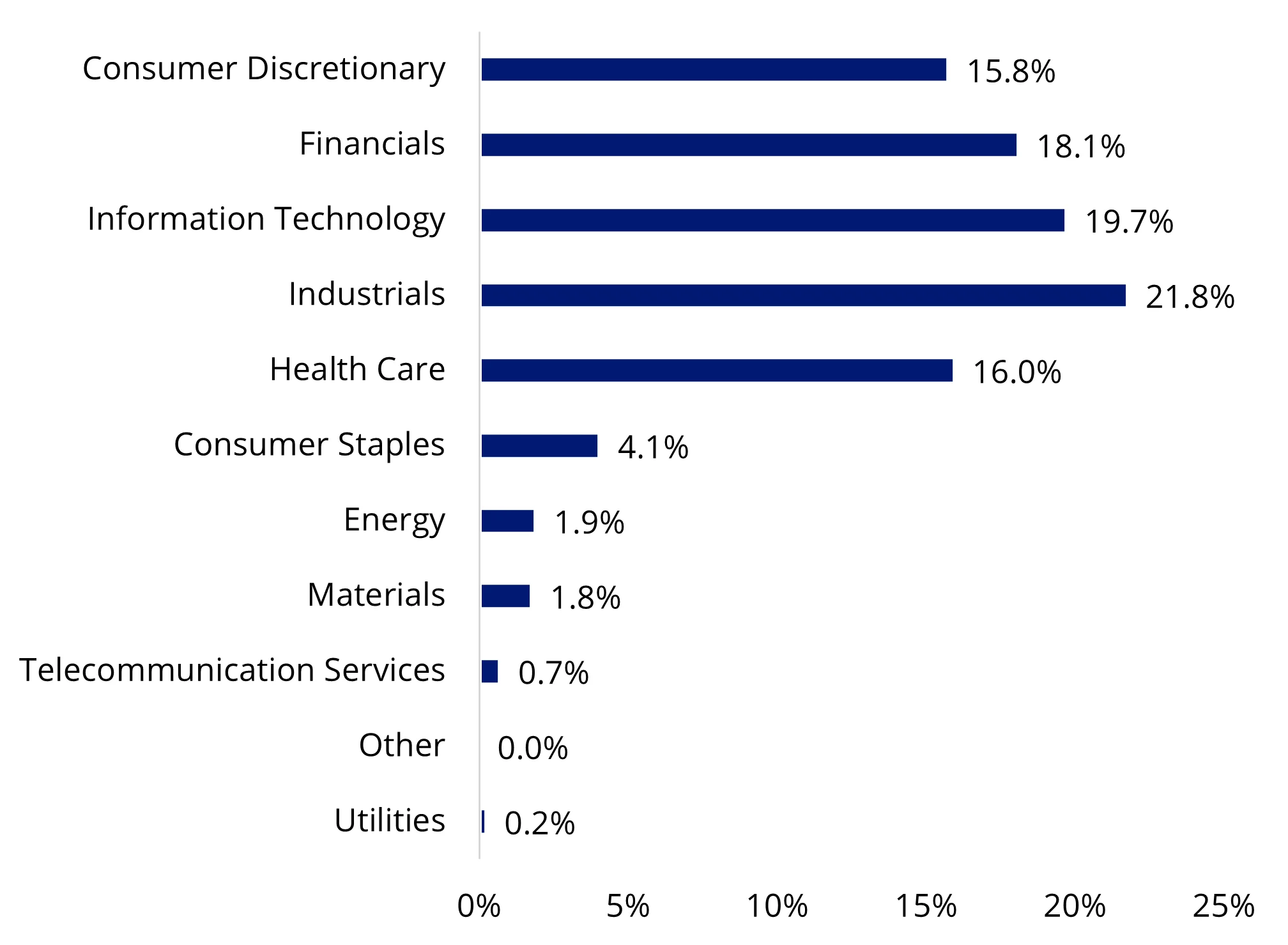

While none of the ASX-listed private credit funds are included in the index LEND tracks, the LPX Listed Private Credit AUD Hedged Index (LEND Index) due to the lack of underlying holdings transparency, we think there could be concentration risk when selecting an ASX-listed LIT or LIC for private credit exposure. Two of the largest of these, have a greater than 50% exposure to real estate, one of them only lends to real estate. A more diverse loan book, including exposure to larger and more liquid vehicles across industries such as healthcare and IT, may be prudent risk management.

The LEND Index is highly diversified across industries.

Chart 1: LEND Index industry sectors

Source: LPX, as at 28 February 2025. LEND Index is LPX Listed Private Credit (AUD Hedged) Index.

A final thought on Marks’ note. He finishes by stating that he does not believe that private credit represents a systemic risk. We tend to agree. While there is much work that needs to be done in the sector in Australia to give investors more confidence, we think that the regulator and participants are managing the risks associated with the asset class. Private credit is not like bank lending. Investors have been primarily wholesale or wealthy investors, these investors are unlikely to be levered the way the US banks, and its customers, were in 2008. The private credit funds themselves have seemingly better safeguards too than the property lenders and the many dodgy loans that made up the mortgage-backed securities that became increasingly complex and opaque in 2008. Illiquidity would be a problem for these investors and any associated compression would be problematic but its impact on the rest of the economy would be limited.

Like Marks, we think private credit has a place in a well-diversified portfolio for those investors seeking income, commensurate with risk.

Key risks: An investment in LEND carries risks associated with: listed private credit, interest rates, credit/default, ASX trading time differences, financial markets generally, individual company management, industry sectors, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for more details on risk.

Source

1Financial planning giant abruptly tells advisers to sell Metrics funds

Published: 30 March 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

LPX and LPX Listed Private Credit AUD Hedged Index are registered trademarks of LPX AG, Zurich, Switzerland. The LPX Listed Private Credit AUD Hedged Index is owned and published by LPX AG. Any commercial use of the LPX trademarks and/or LPX indices without a valid license agreement is not permitted. Financial instruments based on the index are in no way sponsored, endorsed, sold or promoted by LPX AG and/or its licensors and neither LPX AG nor its licensors shall have any liability with respect thereto.