The explosion in plain sight

One of the biggest trends in investing is getting little attention. Its popularity is rising as equity markets continue to fall and active managers continue to struggle.

Investing is changing. Be at the forefront of this change.

We highlighted in a recent Vector Insights that international and Australian investors were flocking to smart beta. Bloomberg’s Eric Balchunas has made this observation.

SEMI-SHOCK: Smart-beta seems like one of those things that came and went but the flows tell another story, these ETFs have taken in $250b in the past 18mo, they're best run by far and 5x more than theme ETFs and 6x more than ESG ETFs, which tend to get all the attn. pic.twitter.com/SGVwenuBWQ

— Eric Balchunas (@EricBalchunas) July 25, 2022

And, just like in the US, investors have also been flocking into Australian smart beta ETF’s in droves in recent years, besting thematic and ESG ETFs so far in 2022.

Chart 1: Australian smart beta net flows

Source: ASX, VanEck

The explosion of Smart Beta exchange traded products in recent years has further blurred the lines between active and passive management via the creation of leading edge, data driven and cost efficient products within the global exchange-traded products landscape.

In 2018 there were 27 products offered in the Smart Beta space in Australia, today there are 57, that’s an increase of almost 200 per cent. The trend reflects a broader global movement, with over 1,000 Smart Beta products now offered worldwide.

Smart Beta is the term given to ETFs (Exchange Traded Funds) which track an index that differs from the traditional market capitalisation approach of selecting shares, bonds or other assets.

The common thread among these products is that they seek to either improve their return profile or alter their risk profile relative to more-traditional market benchmarks by targeting an investment outcome.

Now in its seventh year, VanEck's smart beta survey was conducted in July and August 2022 among Australian financial professionals. We believe the survey is the largest of its kind. This year, almost 650 financial professionals working in an advisory capacity in Australia responded.

And the results underpin the experience. The proportion of net flows going into smart beta strategies rose to 26.6% as at 31 August 2022, up from an increase of 20.2% a year ago, with that gain outpacing both active and market capitalisation strategies. Smart beta strategies now make up 15.2% of the total ETP industry, up 8% from the prior year, again outpacing growth in active and market capitalisation strategies

The VanEck Smart Beta survey indicates this trend could continue. The survey reveals two in three financial professionals have increased usage of ETF’s over the last 12 to 18 months, with reduced total portfolio costs being the main driver. Over half of those surveyed, or 56%, said they are using smart beta products as a replacement for active management.

It is worth noting that this is the first time the survey has been conducted during a sustained bear market. It is worth analysing the results, because they could paint a picture investing a new economic regime.

The rationale for smart beta: diversification and performance are the key drawcards

Diversification and strong performance are the major motivating factors for financial professionals when selecting Smart Beta strategies in portfolio construction. Investors and their advisers are realising that actively managed funds often underperform their benchmarks, so investors are shifting to smart beta to seek targeted performance outcomes for lower fees. Other motivating reasons to use smart beta include reduced volatility, improved portfolio diversification and lower costs as the chart below shows.

Source: VanEck seventh annual smart beta survey.

The approaches being used: single factor smart beta approaches lead in equities

Many financial professionals (46%) are now using smart beta strategies in client's portfolios according to the survey, compared to only a third (37%) in 2016. A single quality factor is the leading Smart Beta approach in equities. Quality strategies have increased in popularity by 50% year on year compared to 41% in 2021.

Source: VanEck seventh annual Smart Beta survey.

Most financial professionals use Smart Beta ETFs for International equities (70%) and Australian equities (69%) exposure. Almost 50 per cent of advisors said they are currently using a single factor quality Smart Beta ETF approach, the second most popular approach was equal weighting, with 36 per cent of advisors or brokers utilising this factor, and ESG came in third with around 30 per cent of advisors utilising this ETF style. Moreover over 42 per cent of financial professionals are currently using two or three smart beta strategies, with almost 1 in 2 of those currently using smart beta considering an additional allocation to the space.

Why is it exploding: high levels of satisfaction and as a substitute for active

The VanEck survey also reveals very high levels of satisfaction among smart beta users, with almost 99% of advisors using smart beta strategies very satisfied or extremely satisfied with their smart beta investments. Half of these advisors are planning to increase their smart beta allocation over the next year.

We have written many times about smart beta being a disruptor of active management.

Active managers can no longer afford to ignore the popularity of smart beta ETFs which have continued to innovate while showing resilience during market volatility. Over 56 per cent of financial professionals surveyed said they use smart beta as a replacement or substitute for active management.

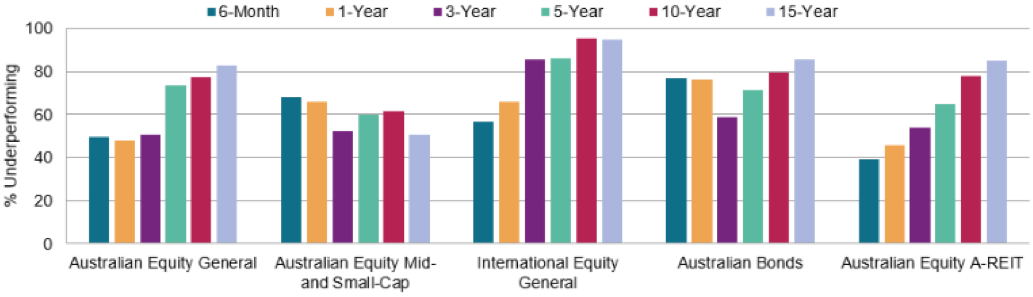

The persistent underperformance of active managers is not a new phenomenon, over the past 15 years almost 83 per cent of actively managed funds have underperformed the S&P/ASX 200 according to research from S&P Dow Jones. While recent research reveals an increasing majority of active funds underperformed in every reported category over the longer-term.

Exhibit 1: Percentage of underperforming active Australian funds

Source: S&P Dow Jones Indices LLC, Morningstar. Data as of June 30, 2022. Past performance is no guarantee of future results. The S&P/ASX Australian Fixed Interest 0+ Index was launched Sept. 5, 2014. The S&P/ASX Mid-Small was launched Aug. 15, 2011. All data prior to index launch date is hypothetical back-tested data. Chart is provided for illustrative purposes and reflects hypothetical historical performance. Please see the Performance Disclosure at the end of this document for more information regarding the inherent limitations associated with back-tested performance.

These are staggering numbers and explain why active managers are continuing to lose market share to the exchange traded products market. The major advances in information and investment technology in the last decade have given investors the horsepower necessary to efficiently manage more-complex Smart Beta strategies which deliver performance driven results in a low cost and efficient manner.

The explosion of smart beta is happening. Market down turns can force investors to consider their portfolio approaches. The VanEck smart beta survey has consistently shown that smart beta’s acceptance and adoption among Australian investors is increasing. Flows and product growth is starting to match. While markets are currently in flux, what is evident is that investing is changing. Investors are more aware of markets, more sensitive to costs and demanding more transparency. All of which benefit smart beta.

Published: 16 September 2022

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.