The ascent of bitcoin

Bitcoin has been in the news since Trump’s election win. The meteoric rise of the digital currency is not without warrant.

In ‘The Ascent of Money’, Niall Ferguson outlines the birth of banking and the radical innovations of the 1700s that allowed European banks to lend more money than they physically held.

Today, we accept this is standard banking practice. Today we live in a digital age.

The use of physical money has been decreasing, the use of digital payments increasing. More recently we have seen the rise of digital currencies. Notably bitcoin which was first of these.

When Ferguson wrote about bitcoin in the 2018, revised version of his book, he said,

“Bitcoin is portable, liquid, anonymous and scarce. It is “digital gold” by design. A simple thought experiment would imply that $6,000 is therefore a cheap price for this new store of value. Around 17 million bitcoins have been mined to date. The number of millionaires in the world, according to Credit Suisse, is 36 million. Their total wealth is $128.7 trillion. If millionaires collectively decided to hold just 1 per cent of their wealth as Bitcoin, the price would be above $75,000 – higher, if adjustment is made for all the Bitcoins that have been lost or hoarded. Even if the millionaires held just 0.2 per cent of their assets as Bitcoin, the price would be around $15,000.”

After Donald Trump won the Presidency last week, the price of bitcoin smashed through that US$75,000 barrier.

In the time since it was first created, in 2008, to now, bitcoin has become a Presidential campaign issue, and yet despite many predictions of its collapse, it continues to rise.

It is therefore worthwhile to understand why it is becoming more and more important and what is driving its demand.

Bitcoin’s beginnings

Bitcoin was created in 2008 after the financial crisis by an unknown person, or group of people, using the pseudonym Satoshi Nakamoto. The original intention was to develop a type of money that people could instantly send to each other over the internet, without going through a bank or any other third party. The intention was to make it cheaper and quicker to transact. This is accomplished through blockchain technology.

Earlier on, there were attempts to ban digital assets such as bitcoin in certain countries. As bitcoin evolved investor interest increased and the infrastructure networks to support it progressed.

Regulators and governments globally started to recognise that bitcoin and digital assets could be a technological innovation that is here to stay.

Naturally there was apprehension and scepticism about bitcoin as scandals (notably, FTX and at Binance) and collapses (for example, Mt Gox and FTX - again) involving bitcoin exchanges and intermediaries started to mount. The price of bitcoin continued to rise.

While many investors were worried by these scandals, it is worthwhile to remember that these intermediaries were never the investment rationale for bitcoin, rather they were part of an infrastructure and intermediaries of exchange to make it easier to buy and sell this currency.

The threat of collapse, or nefarious actors have been a feature of all markets. Regulators have responded to ensure market integrity and consumer protection where they can.

The dream of bitcoin has always been peer-to-peer transactions, without intermediaries such as banks and away from governments.

Inflation’s impact on ownership

So recently, when inflation reared its head in developed markets, demand for the digital currency increased.

You need only look back to before developed market inflation to understand why this has happened. While developed markets were experiencing historically low inflation in the years following the GFC, the same was not the case in many emerging markets. And the trend in emerging markets was, as inflation increased the appetite for crypto grew.

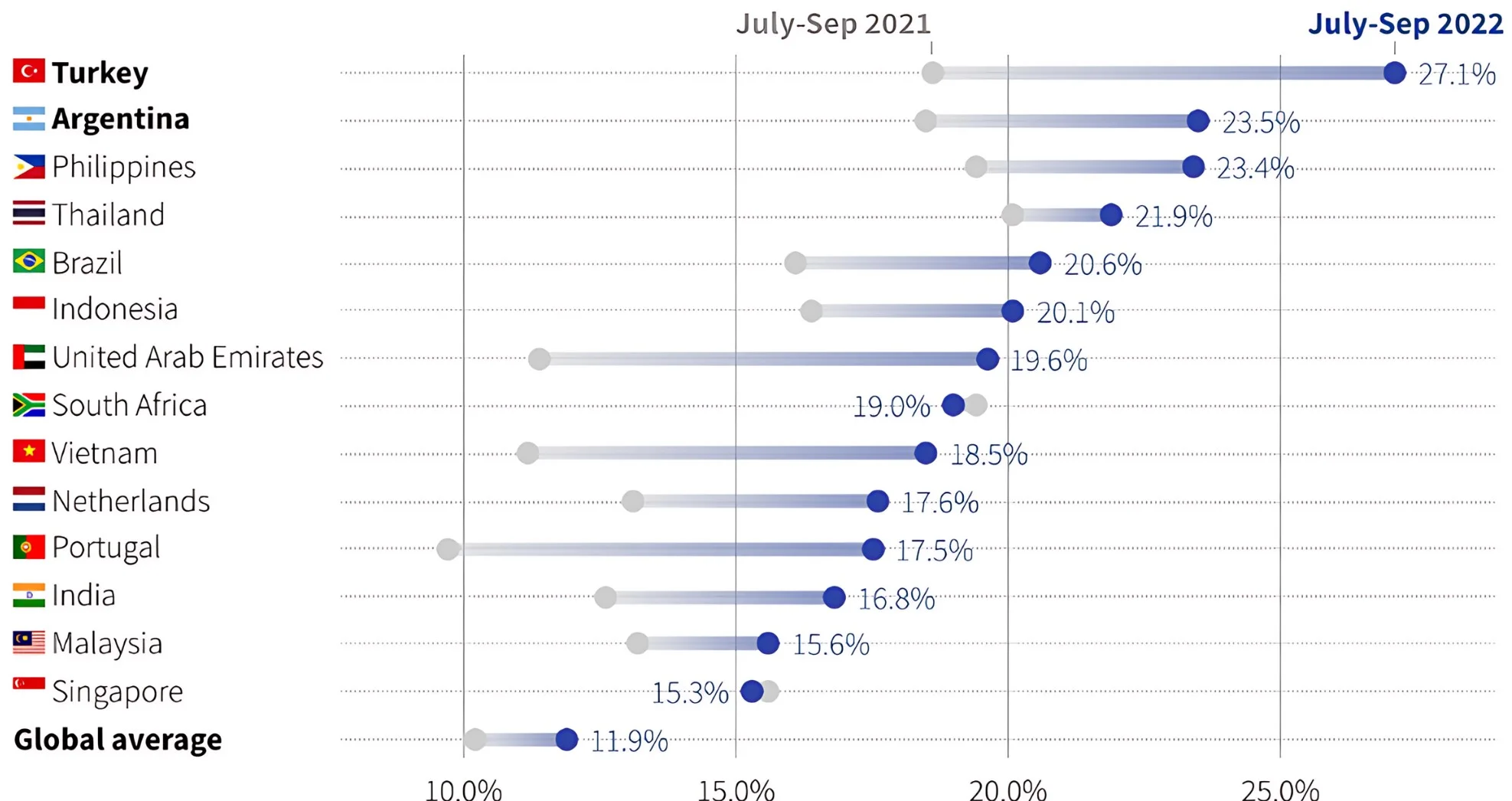

Turkey and Argentina are good examples. In March 2023, Turkey's annual inflation was 50.51%, Argentina's was even higher at 104%. At that time, Reuters published an article highlighting the ownership of digital currencies in Turkey was the highest in the world at 27.1% followed by Argentina at 23.5%, according to data from research firm GWI.

Chart 1: Share of internet users aged 16 to 64 who own some form of cryptocurrency in the July to September period 2021 and 2022 (top 15 countries in 2022 shown)

Source: GWI research, Reuters.

Remember, this was at the same time Sam Bankman-Fried was being convicted of defrauding FTX users. Was there any surprise that cryptocurrencies continued to flourish when inflation ravaged through developed markets?

What followed the arrival of bitcoin ETFs

As regulators such as Australian Securities and Regulatory Commission (ASIC) and the US Securities and Exchange Commission (SEC) were responding to ensure market integrity and consumer protection, they were also assessing bitcoin ETFs.

In October 2023, in the US, when the D.C. Circuit Court of Appeals handed down a decision that effectively ordered the SEC to abandon its rejection of spot bitcoin ETFs, they finally had the green light to be listed in the US.

Bitcoin’s price enjoyed a rise following the launch of the ETFs in the US.

Bitcoin adoption has grown substantially as it has become more mainstream. Now, more than ever, merchants and businesses are accepting bitcoin as a form of payment and infrastructure has been built to make it more convenient for the average person to use. The development of user-friendly wallets, exchanges, and marketplaces has removed the technical barriers to entry that existed in bitcoin’s early years.

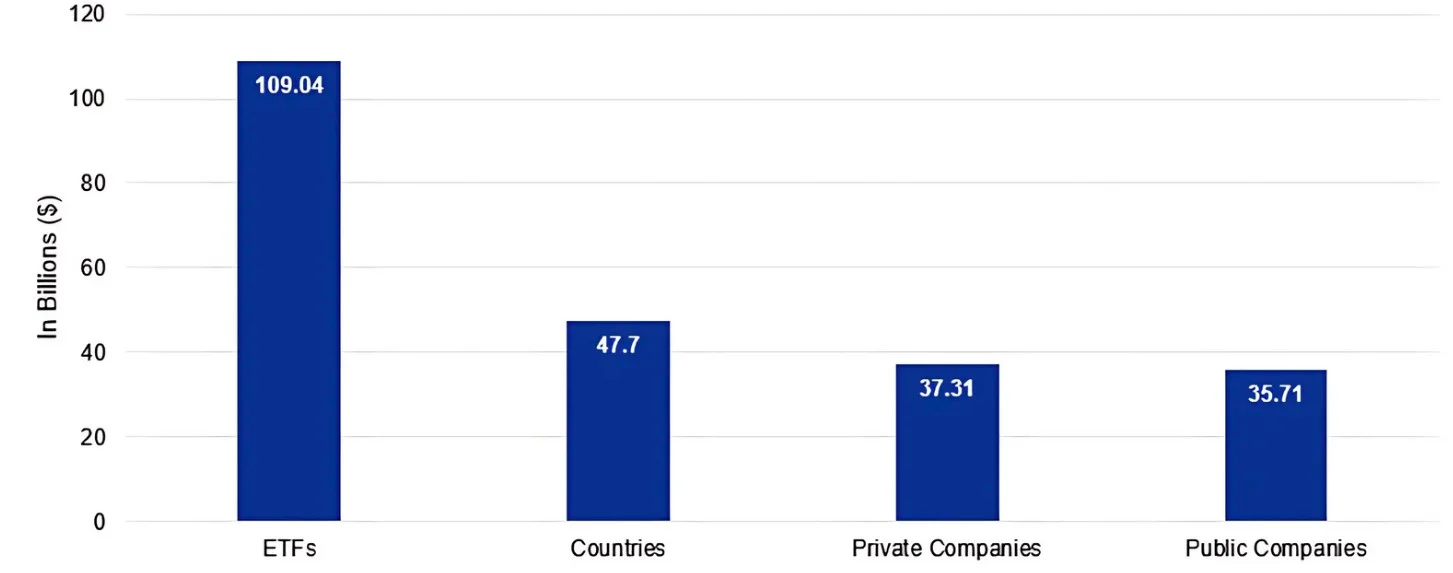

Bitcoin interest among institutional investors has also increased. Hedge funds, asset management firms, and high-net worth investors are using bitcoin as a potential store of value or a portfolio diversifier. Some have indicated they are using it as a potential to hedge against inflation (given bitcoin has only been in existence a short time, it is too early to tell if this investment rationale holds true, but it will be worth monitoring as new market cycles eventuate). Approximately US$229.7 billion worth of bitcoin are now held by ETFs, countries, public and private companies.

Chart 2: BTC holdings in publicly traded, private companies, ETFs and countries

Source: Buybitcoinworldwide as of 13/11/2024.

Bitcoin’s future under Trump

Bitcoin’s price has now had another kick with President Trump’s election victory. Trump was the first Presidential candidate to brand himself “pro-crypto”. Among his pledges were:

- A strategic national crypto stockpile;

- A change in direction, in terms of approach to regulation and from the aggressive stance taken under the previous administration;

- Bitcoin mining in the US; and

- Fed rate cuts.

While it is unclear how Trump will implement some of these, the overriding optimism for bitcoin and unregulated peer-to-peer transactions could also be attributed to Trump’s other big campaign point, the Bill of Rights.

Trump spoke a lot about the first amendment, but free speech is not the only liberty protected under the Bill of Rights. The fourth amendment protects US citizens from unreasonable searches and seizures by the government. According to a Coin Center report, regulating cryptocurrency, could be unconstitutional under the fourth amendment because it would be a warrantless search and seizure of information private to cryptocurrency users.

The report argues that existing Banking Secrets Act (BSA) recordkeeping and reporting requirements, which have been upheld as constitutional by the US Supreme Court, does not extend to blockchain technology where no third-party intermediary exists.

The optimism for bitcoin’s future under a Trump administration is not without warrant (pun intended).

Niall Ferguson, highlighted the Coin Centre paper and the evolution of cryptocurrency around this time last year, in a Bloomberg opinion piece entitled, ‘If you held on for dear life, it's a Merry Cryptomas!’

Ferguson had not held on. At the time he wrote his article, the bitcoin price was around $43,000, having risen from $15,460 a year earlier. It looks like, with the approval of bitcoin ETFs, combined with increased adoption and the return of Trump, this year could be another Merry Cryptomas!

Key risks: An investment in VBTC involves extremely high risk and the potential for loss of all capital invested. Investors should actively monitor their investment as frequently as daily to ensure it continues to meet their investment objectives. Risks associated with an invest in the fund include those associated with pricing risk, regulatory risk, custody risk, immutability risk, ASX trading time risk, concentration risk, environmental risk, currency risk, operational risk, underlying fund risk and forking risk. See the VanEck Bitcoin ETF PDS and TMD for details.

Published: 14 November 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

This information is prepared in good faith by VanEck Investments Limited ACN 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of units in VanEck ETFs traded on the ASX. Units in VBTC are not currently available. The PDS will be available at vaneck.com.au. The Target Market Determination will be available at vaneck.com.au. You should consider whether or not any VanEck fund is appropriate for you. The level of investment risk is considered extremely high. Investors must be willing to accept a significant or total loss of their investment. See the PDS for details. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from any fund.