Understanding equity classification schemes can help investors

Considering how your equity portfolio has performed as it has, and how it may fare in future is crucial. This is where knowing how shares are classified comes in.

The taxonomies of share investing

Taxonomy is a branch of science concerned with classification. It is associated with naming, describing and classifying all the different types of organisms in the world, including plants, animals and microorganisms.

Taxonomy aims to classify and group different organisms by their shared traits and lineage. This helps us understand the many diverse species we share our planet with.

Chart 1: Biological classification

Classification schemes and hierarchies are not the domain of biology. Humans classify all sorts of things, including companies. Like science, the benefit of a classification scheme is better understanding. A classification system enables accurate research, portfolio management, and asset allocation. It allows for meaningful comparisons between sectors and industries worldwide.

The benefit of a classification system for equities is that it groups companies with similar attributes, being the industry or sector, that they compete in. Often the share prices of companies that are classified together will respond similarly to a change or trend in the macroeconomic environment.

Investors need to understand how their share portfolio is diversified, by sector or industry, to ensure that they are properly diversified, thus mitigating the risk of concentration.

For example, if you recognise your portfolio of shares has too many stocks that correlate to the economic cycle, you may wish to diversify to defensive companies.

This is important because analysing the companies, sectors and industries your portfolio is exposed to, can help you understand why it has performed the way it has. It can also provide the impetus for consideration into the next stage of the economic cycle (see putting it into practice below).

But before we do that, let's look at the different classification systems available to investors. You may have seen references to these on the ASX website or the websites of your fund manager because most equity funds will break down their asset allocation using a classification scheme.

Unfortunately, unlike science, there is more than one classification scheme for equities. The two major taxonomies used for classifying shares into sectors and industries are:

- GICS (Global Industry Classification Standard), developed by index companies MSCI and S&P, and

- ICB (Industry classification benchmark), developed by Dow Jones and FTSE.

These classification systems are reviewed regularly and change in response to shifts in market dynamics and new industries.

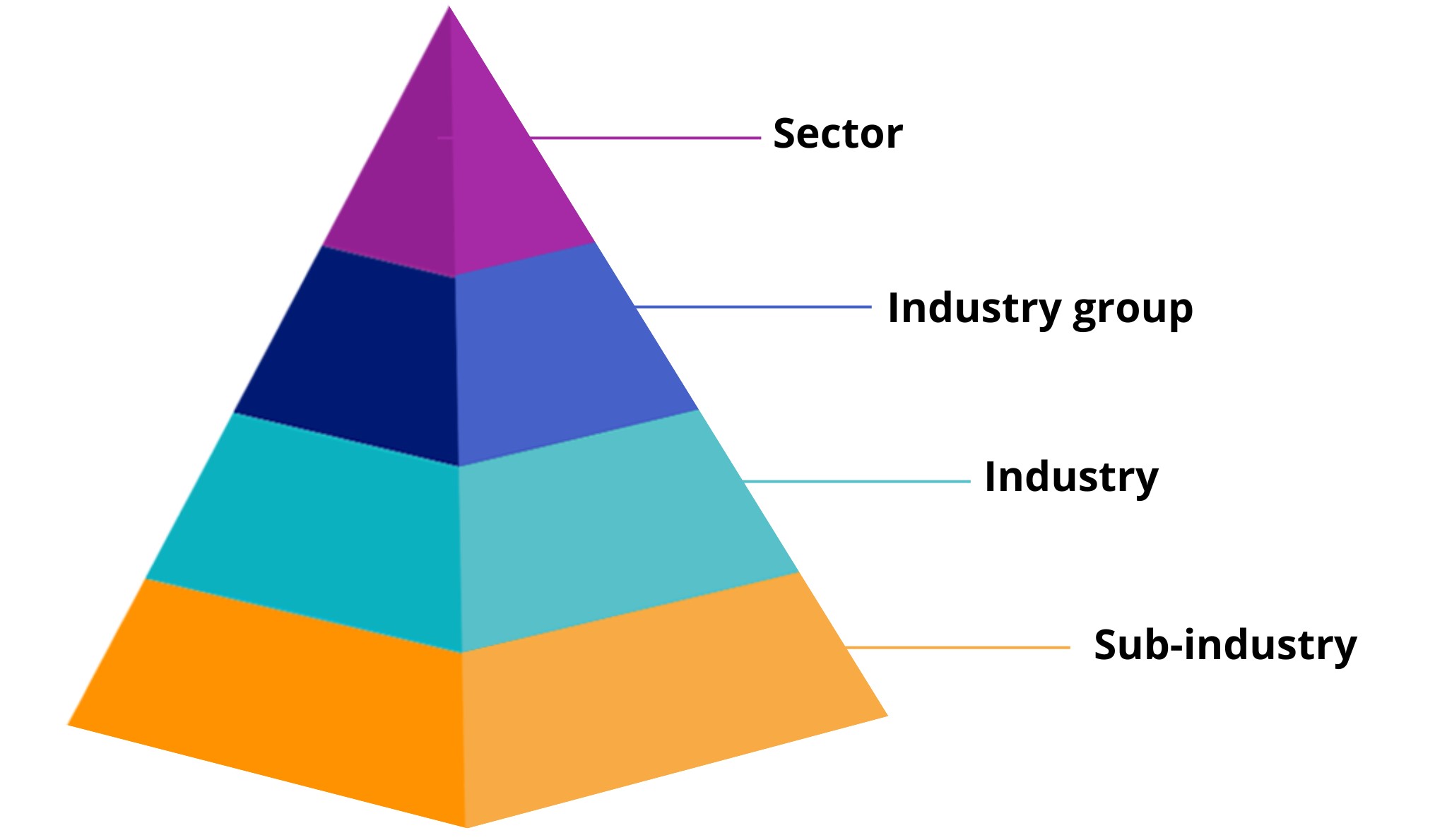

GICS

The GICS taxonomy system consists of four levels. There are 11 sectors, 25 industry groups, 74 industries and 163 sub-industries.

Chart 2: GICS classification

The 11 sectors are:

- Consumer discretionary

- Consumer staples

- Energy

- Materials

- Industrials

- Healthcare

- Financials

- Information technology

- Real estate

- Communication services

- Utilities

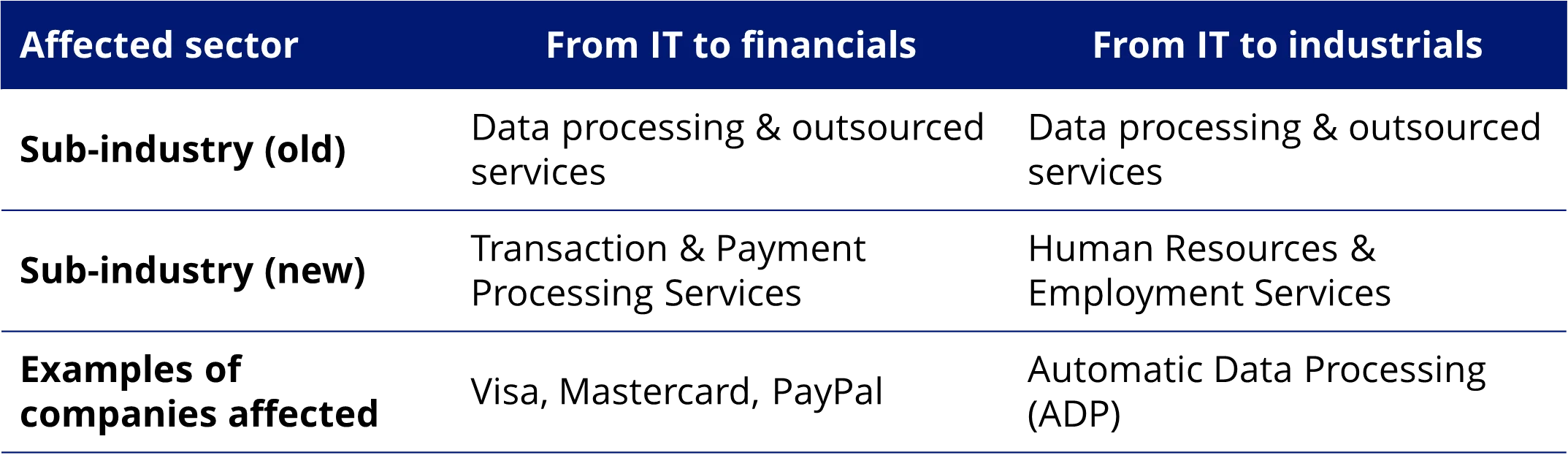

The most recent changes to the classification system were in March 2022, which among other changes, reclassified and changed the data processing & outsourced services subsector companies (e.g. Visa, PayPal) from information technology to industrials and financials.

Table 1: Adaptation and review: Recent changes to GICS taxonomy

Source: MSCI, S&P, VanEck

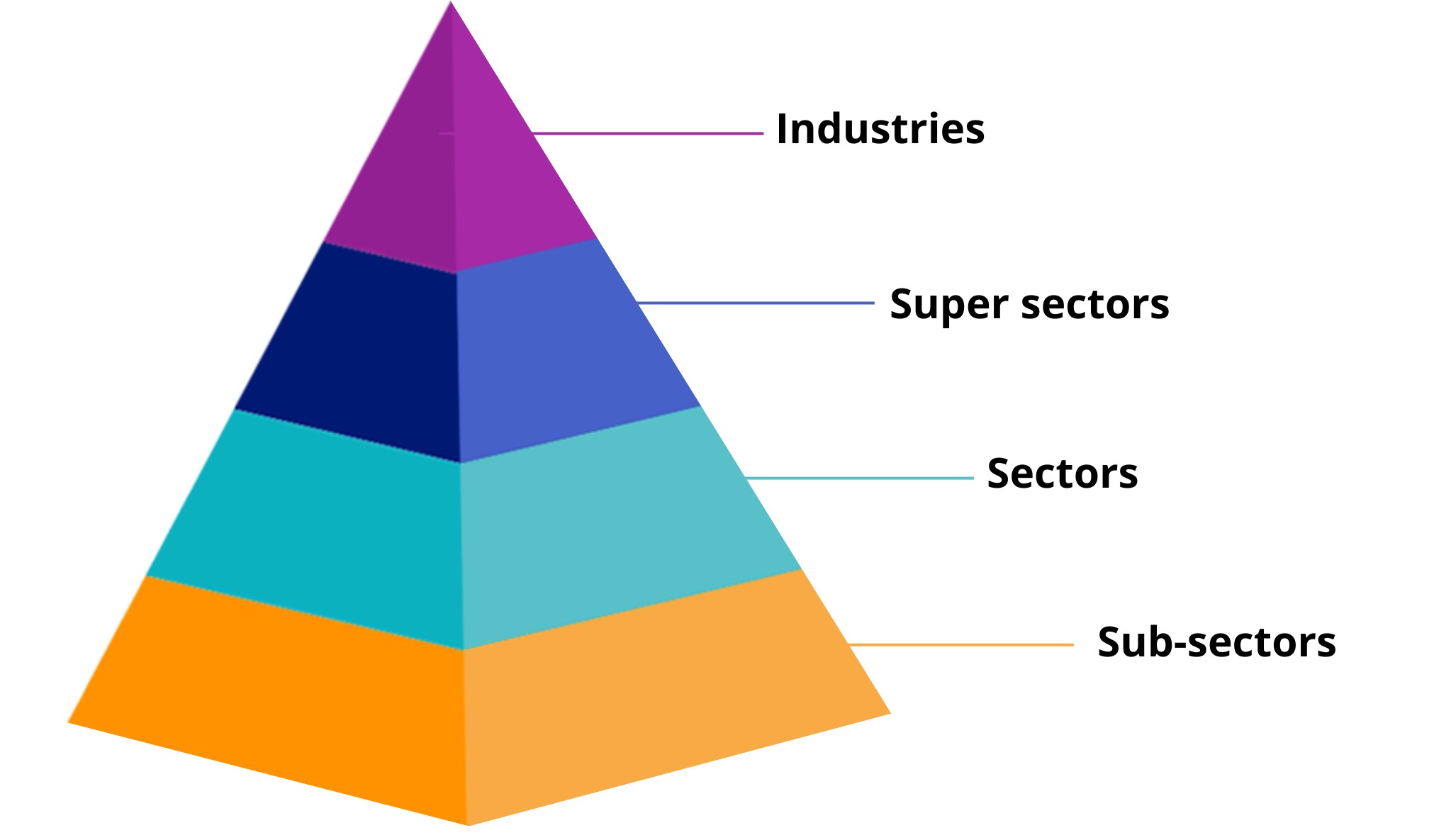

ICB

The ICB taxonomy system is also a four-tier structure. In this system, there are 11 industries, 20 super sectors, 45 sectors and 173 sub-sectors.

Chart 3: ICB classification

The 11 industries are

- Technology

- Telecommunications

- Healthcare

- Financials

- Real Estate

- Consumer Discretionary

- Consumer Staples

- Industrials

- Basic Materials

- Energy

- Utilities

The most recent significant change to the ICB classification was in 2020 when consumer discretionary and consumer staples, replaced the old consumer goods and consumer services classification, oil & gas was renamed energy, and the real estate industry was introduced, having previously been a super sector within financials.

Putting it into practice

You can see that there is not much difference between the two taxonomies.

Investors are curious about how companies perform during the different parts of the economic cycle. Cyclical and defensive stocks have different performance characteristics depending on the economic cycle. Cyclicals are companies, and sectors, that correlate positively to economic activity, that is their share prices rise when there is a rise in economic activity, and their prices fall when economic activity falls.

Defensive sectors and companies, on the other hand, tend to have less correlation to economic activity. They tend to hold up as activity falls because the goods and services they produce have inelastic demand. Defensives tend to lag cyclical companies when economic activity rises because they don’t experience the same level of increase in activity as cyclical companies.

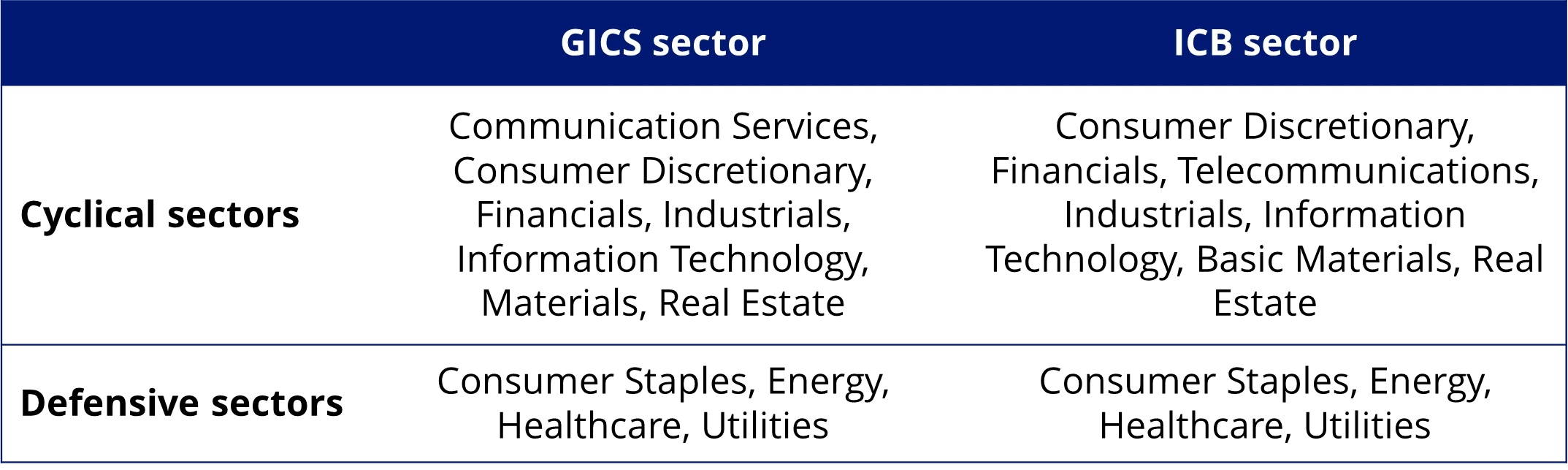

If we consider the classification schemes noted above:

Table 2: GICs sector and ICB sector

You may have been reading recently that economic growth is slowing. That would imply that investors with overweight positions in cyclical stocks may underperform those portfolios with bigger allocations to defensive sectors.

Many investors try to time the market, but this is nearly impossible. Rather, long-term approaches focused on diversification can help investors navigate the economic cycles.

Thinking about Australian equities as an example, an economic downturn may be problematic for investors with broad exposure to the Australian market, because our two biggest sectors, financials and materials (or basic materials) represent over 50% of our share market, by size.

This is how understanding the sectors and industries can help investors. If you know the sectors and industries you are (over) exposed to, you may be better able to diversify and build a long-term portfolio to help navigate markets. In Australian equities, considering an equal weight approach could reduce the concentration to cyclical sectors that may underperform defensive sectors in an economic downturn.

In this way understanding the taxonomy of equities can help.

Like the behaviour of organisms that taxonomists classify, the share price of companies will be unpredictable, but the classification schemes developed by the industry aim to help investors. If investors understand them, it could help them understand how their portfolio responds to macroeconomic data and help them build more diverse, robust portfolios.

Published: 23 August 2024

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.