Why the US dollar is still king

The US dollar is king. The dollar has been the world’s reserve currency since the end of the second World War. The dollar also dominates international trade and finance. However, rising geo-political tensions, surging inflation and US sanctions on Russia have seen talk of de-dollarisation come to the fore in recent months.

Investors should pause and think about the greenback.

Murmurs of the dollar losing its reserve currency status have in part been fueled because central banks, from the likes of China, India and Brazil, have been buying gold to replace dollars in their reserves at the fastest pace on postwar record. Understandably a number of emerging nations may be trying to cut dependence on the dollar, fearing weaponisation by the US. However, we think the de-dollarisation story has been overblown and that the greenback is still king.

The dollar remains pre-eminent on the majority of metrics that define a global reserve currency. As economist Gerard Minack recently said, “most of the attributes that made the dollar the global reserve currency remain intact. The United States remains the world’s largest economy (in common currency terms, which is the metric that matters); the US has an open capital account; the US has a relatively uncorrupted judiciary; and the US has the world’s deepest and most liquid financial markets. Moreover, the US dollar is the incumbent: being the world’s reserve currency creates self-reinforcing network benefits.”

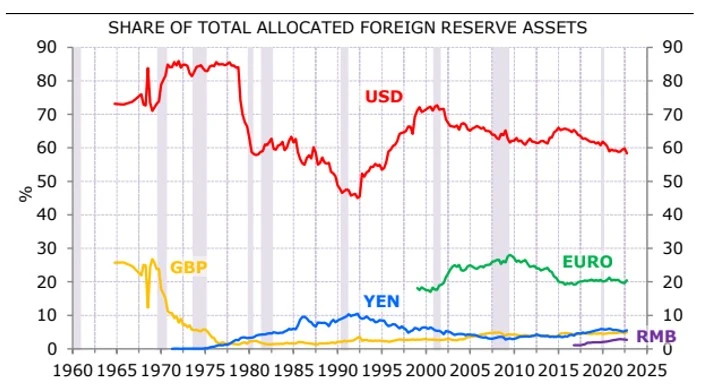

Chart 1: US dollar remains the most important reserve asset

Source: IMF, NBER, Minack Advisors

To put some meat on this; the Bank for International Settlements’s latest triennial FX survey indicates that the US dollar’s share of all currency turnover has actually climbed from 85 per cent in 2010 to 88 per cent last year. In global finance it is similarly dominant.

The network effects of the dollar cannot be underestimated. The use of the US dollar in international trade and finance has become a self-reinforcing cycle. As more countries and businesses use the dollar for their transactions, it becomes more convenient and efficient to continue to do so, further reinforcing the dollar’s dominance as the world’s reserve currency.

According to The Economist, “the doubters’ excitement has become detached from reality. The greenback exerts an almighty gravitational pull on the world economy that has not materially weakened—even if America has recently found that there are real obstacles to exploiting its currency’s pre-eminence.”

The best illustration of the US dollar’s unique status is the global market for oil trading. Most of the trade is denominated in US dollars, even when the parties trading and the barrels of crude have nothing to do with the US. The political will to ease major markets such as commodities off the dollar is apparent; Brazil’s president Luiz Inacio Lula da Silva has called for emerging countries to develop a new currency and move away from the dollar, while Saudi Arabia has said it is in negotiations to conduct a portion of its oil trade with China in renminbi. But the practicalities of trading commodities in non-dollar denominated currencies are difficult.

“Challengers would need to overcome the dollar’s dominance in oil benchmarks and financial futures. The only credible alternative is the renmimbi benchmark traded on the Shanghai International Energy Exchange,” said the Financial Times.

Moreover, the Shanghai Futures Exchange’s (SHFE) market share would only rise to 7% from 5% if the Saudis chose to price all their Chinese oil export in renminbi, according to analysts from Norwegian Bank DNB.

“Claudio Galimberti of Rystad Energy notes that a deeper, more liquid Chinese market would need to evolve to draw traders away from trusted Brent. Users would then be left holding renminbi, a currency which is not a freely traded reserve currency like the dollar, or the euro.”

Morgan Stanley currency analyst Stephen Jen recently said, “while the Global South seems unwilling to continue to hold dollar assets, they do not seem to have the ability to divest from the US dollar as an international currency, particularly for financial transactions. We suspect it will be very difficult to overcome the strong network effects that have been behind the dollar’s international currency status.”

In short, the US dominance of the financial system may lessen but the greenback will remain the currency king. And for Australian investors, we believe it still retains its safe-haven status.

Published: 07 May 2023

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.