Banking on Australian property

Residential mortgage-backed securities represent one of Australia’s fastest-growing forms of structured finance. In 2024, this asset class hit a landmark $56.35b of issuance1, representing 31% year-on-year growth since 2017.

This growth has been fuelled by strong interest from domestic and offshore investors, who have been drawn by its attractive yields, low historical default rates and robust underlying collateral.

However, mortgage-backed securities are also one of the least well-known asset classes. This lack of familiarity, we think, has not been for any lack of appeal so much as the limited access investors have had to this type of debt security. Since the first issuance in Australia in 1986, residential mortgage-backed securities investment has been restricted to fund managers and professional investors, with high minimum entry costs, which typically start at $500,000.

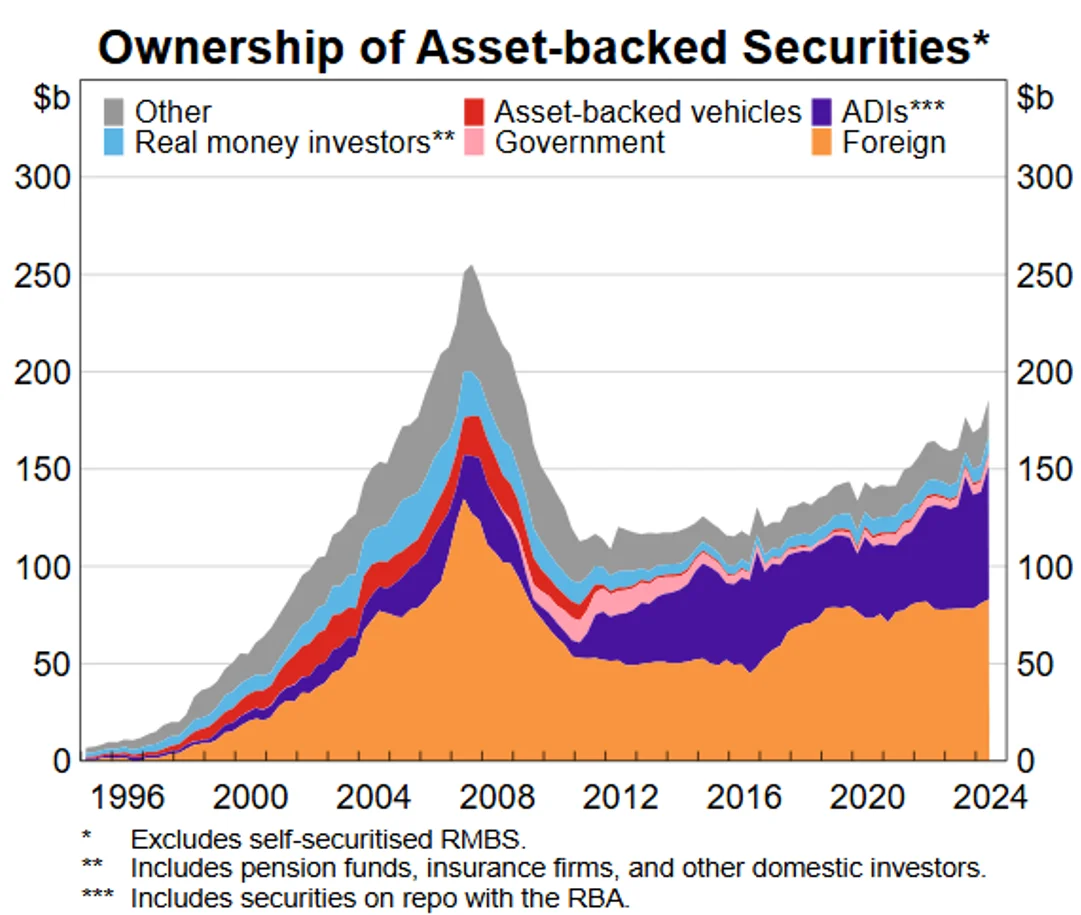

Chart 1: Robust appetite for Australian residential mortgage-backed securities

Source: ABS, RBA, Securitisation System.

Most investors’ exposure to this asset class has been through multi-sector credit or income funds, where residential mortgage-backed securities play a supporting role for yield and diversification.

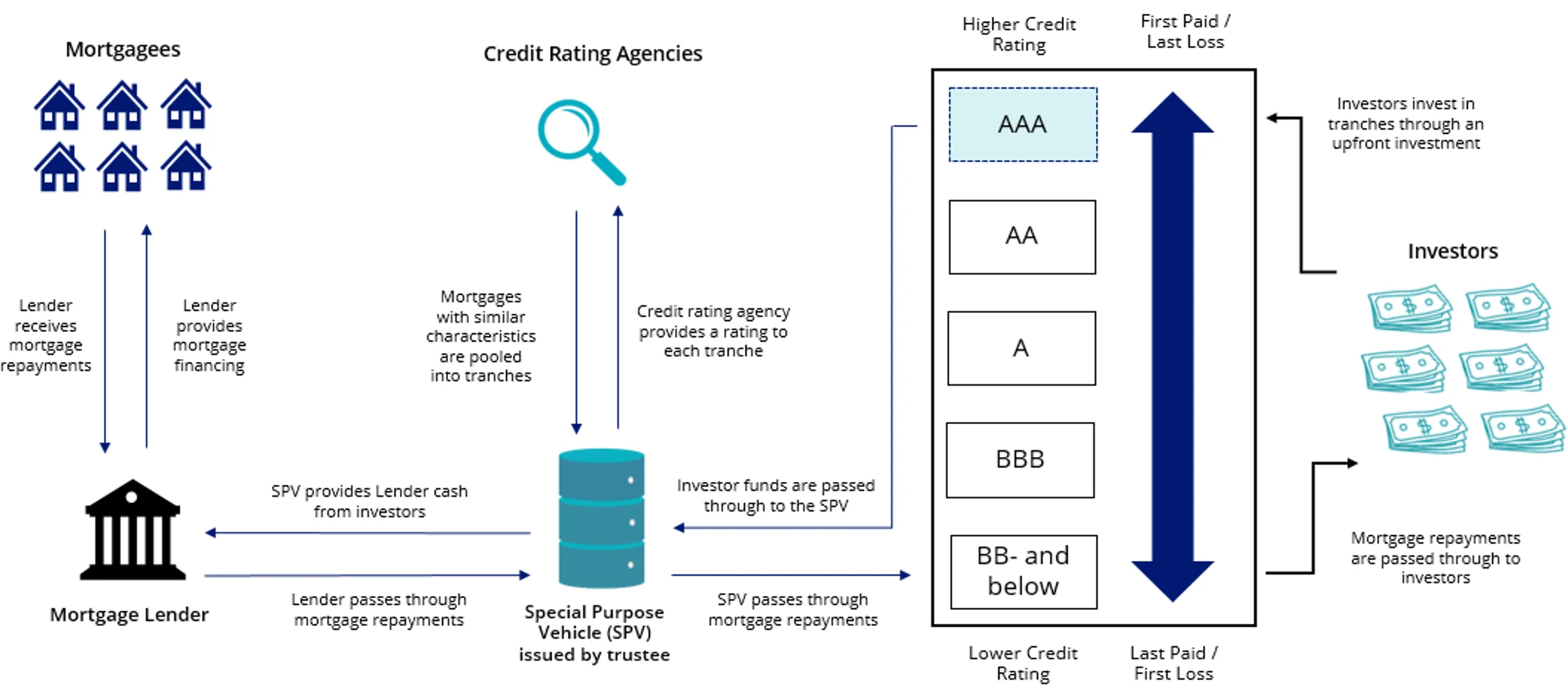

Unpacking residential mortgage-backed securities

A residential mortgage-backed security is a pool of lots of underlying residential mortgages. Bonds are issued backed by these mortgages, and these bonds are then sold to investors as tradable securities. These securities pay regular interest, or coupons, at a ‘floating’ rate (floating rate bonds pay interest that varies with short-term interest rates, as opposed to fixed rate bonds, which pay a fixed rate of interest throughout the life of the bond).

These residential mortgage-backed securities are organised into different classes (commonly referred to as "tranches”) with varying levels of credit protection and yield, providing the ability to tailor allocations based on risk appetite and investment objectives.

Senior tranches in a mortgage-backed securities structure have the least risk (and thus, the lowest yield), with first priority for payment and the most protection from losses. Conversely, junior tranches offer higher returns, but are riskier as they’re at the bottom of the stack when it comes to payment, and are the first to absorb losses in the event of a credit default.

Chart 2: How does an RMBS work?

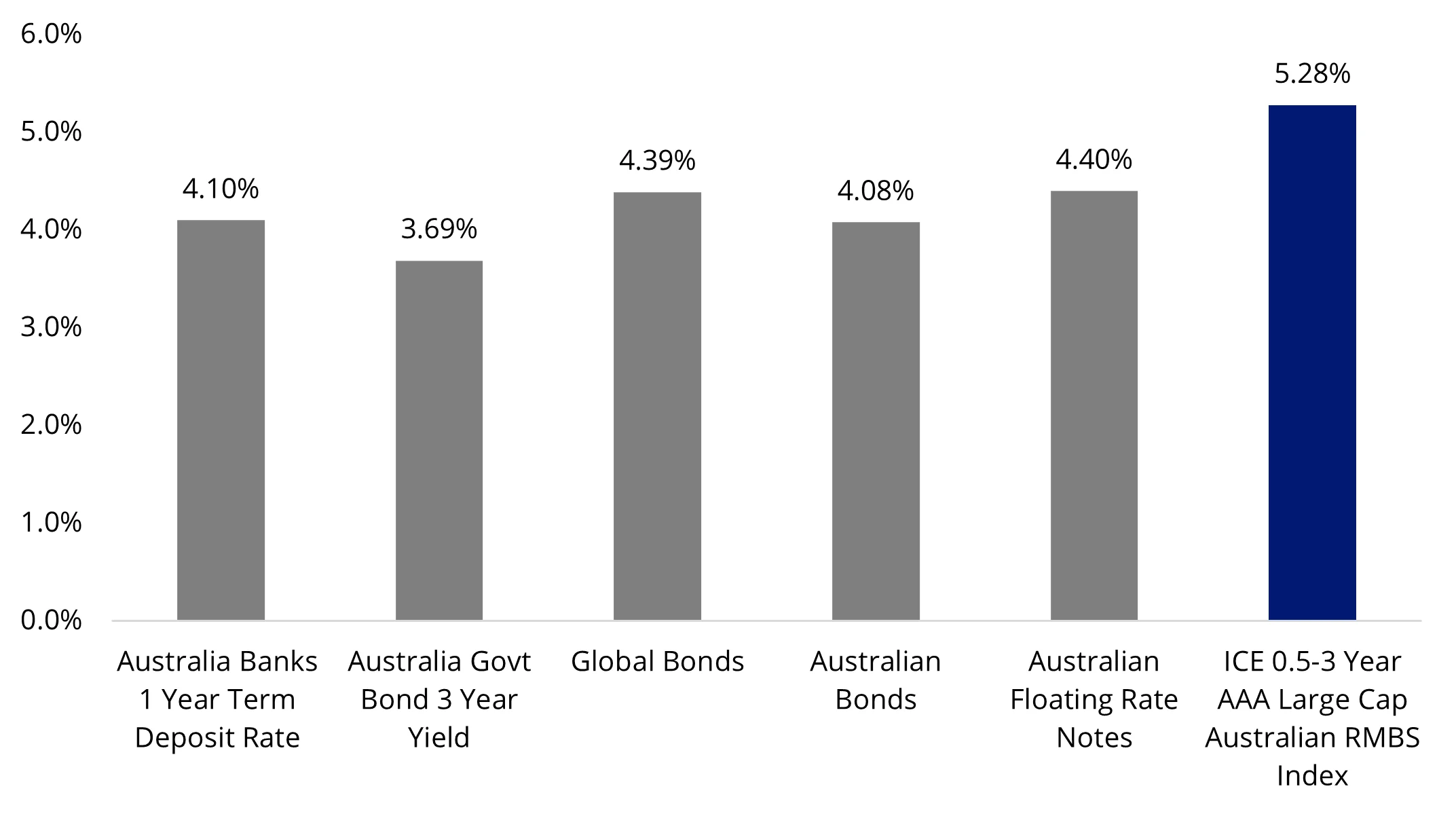

Cashflow from the underlying pool of mortgages are passed through to investors in the form of monthly, floating rate coupons. As these instruments have historically been difficult to access and have more structural complexity than traditional bonds, they have generally provided an uplift when compared to similarly rated corporate bonds.

Chart 3: Yield uplift compared to other fixed income instruments

Source: ICE, Bloomberg, RBA as at 31 March 2025, You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used: Global bonds is Bloomberg Global Aggregate Index, Australian bonds is Bloomberg Ausbond Composite 0+ Yr Index and Australian Floating Rate Notes is Bloomberg Ausbond Credit FRN 0+ Yr Index. RMBS is not a cash asset and should not be considered a substitute for a cash or cash-like investment solution.

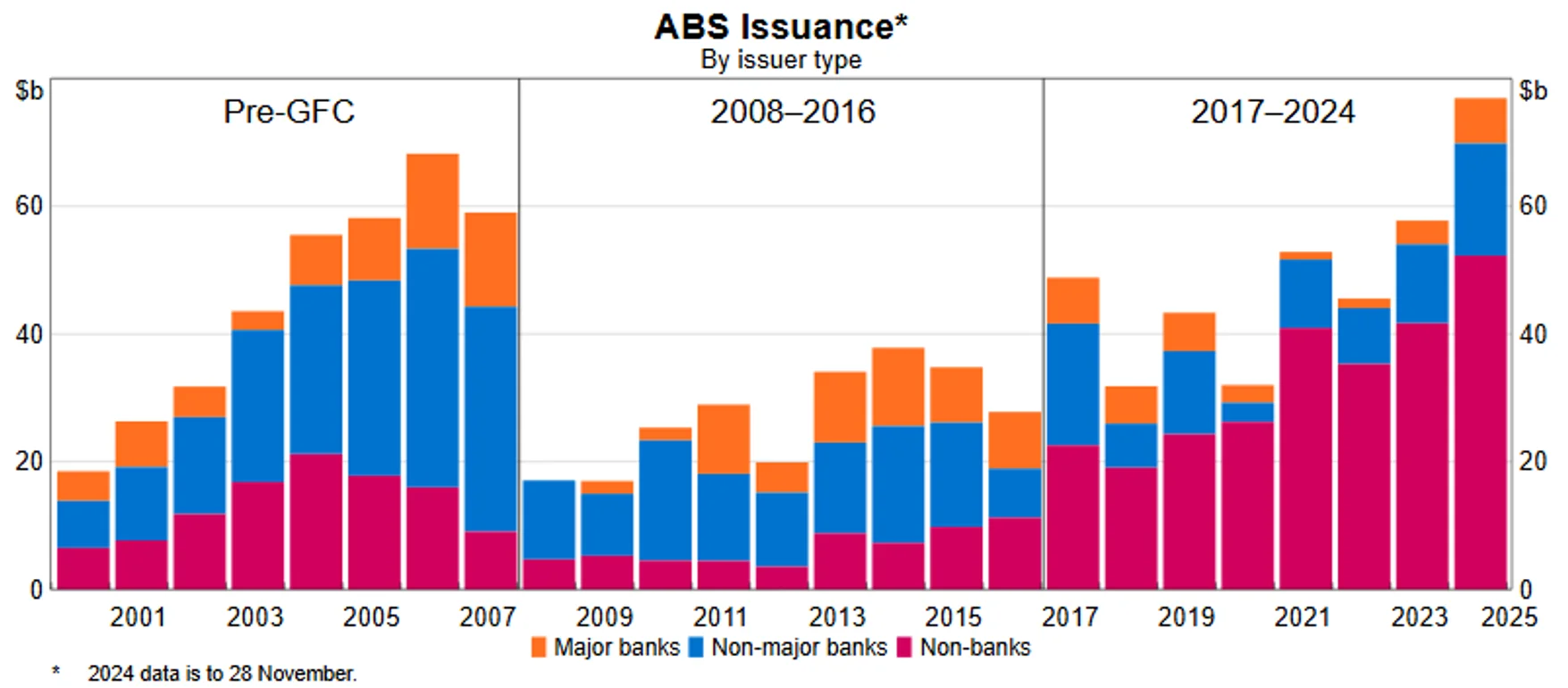

Beyond the big 4: Non-banks are the primary issuer of mortgage-backed securities

Banks and non-bank lenders that originate home loans can issue mortgage-backed securities to fund their home loans. While major banks used to be the main issuers of mortgage-backed securities, they have been overtaken by non-bank residential mortgage lenders in recent years for a number for a few reasons.

Chart 4: Asset-backed issuance in Australia across different lender types

Source: KangaNews, RBA

While banks typically have a range of capital sources for funding mortgage originations (including customer deposits), most non-bank mortgage lenders, have limited access to capital, and typically rely on mortgage-backed securities as their main source of funding home loans.

In the last decade, banks have also pulled back significantly from mortgages as their lending standards became more conservative – a shift largely driven by regulatory restrictions on consumer lending. This has driven a lot more business over to non-bank mortgage lenders. This transition, however, has not led to a deterioration in credit quality. While non-bank lenders are not subject to APRA’s regulation (a status that can change if APRA deems non-banks a threat to financial stability), they are bound by the same ‘responsible lending’ regulations as the banks in regards to strict credit assessment and serviceability checks for consumers.

Australian residential mortgage-backed securities are among the world’s strongest

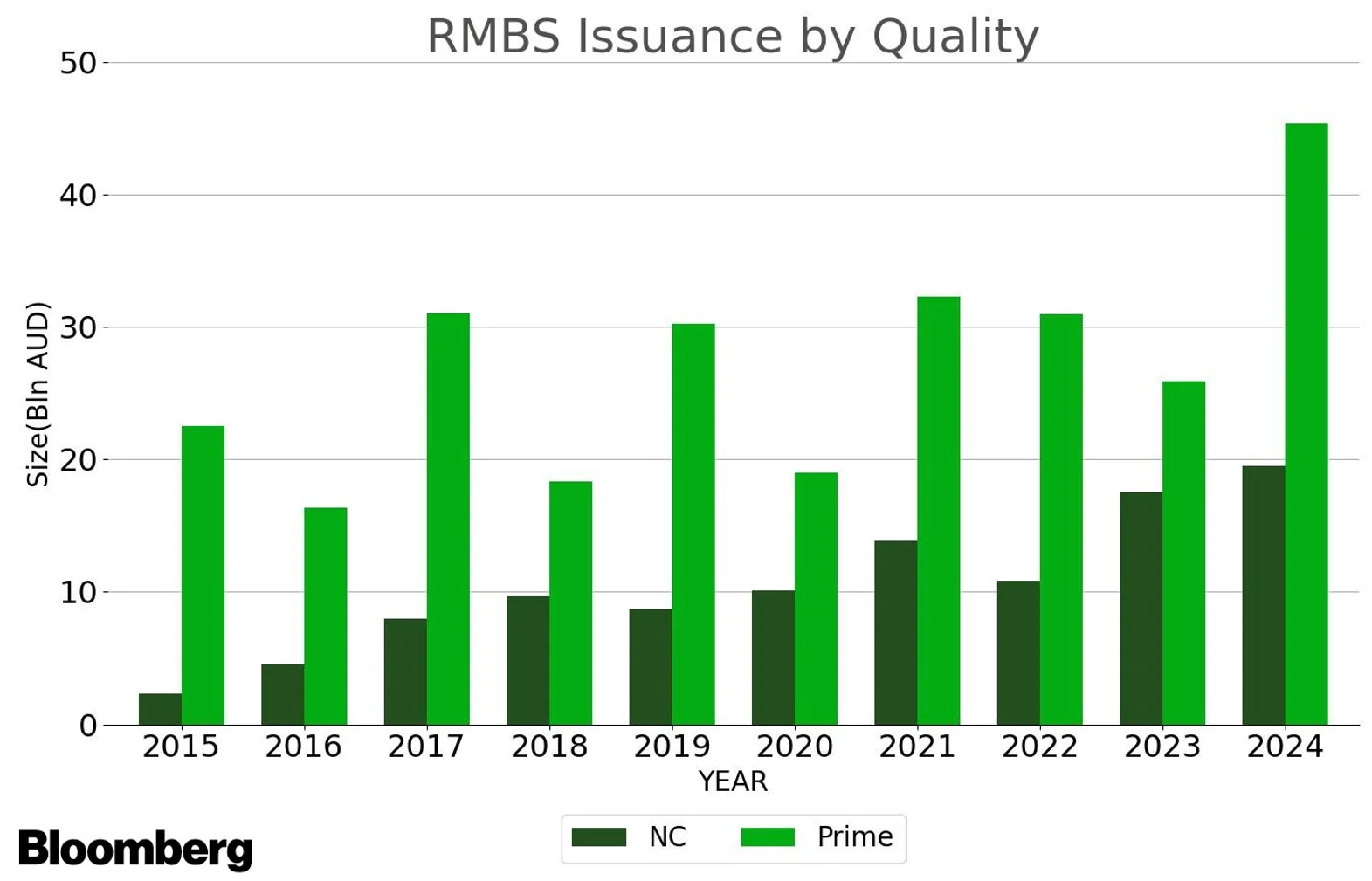

The continued creditworthiness of Australian mortgage borrowers is evidenced by the low levels of arrears and delinquencies, even throughout finance crises such as the GFC, COVID and the recent cost-of-living crisis. Additionally, we have not observed a spike in the issuance of ‘non-conforming’ loans, which are riskier than what are known as ‘prime’ loans. On the contrary, prime loan issuance has continued to outnumber non-conforming by a significant margin – a trend that may reflect investor preference. In the table below, a non-conforming loan is a home loan designed for borrowers who do not satisfy the major banks' standard loan criteria, and typically, these require manual assessment by the credit underwriters, and the additional risk is reflected in the loan interest rate. Prime mortgages, on the other hand, is a term used to define loans offered to borrowers with good credit, low default risk, and a solid repayment history. It is considered the lowest-risk loan a lender can make, and often characterised by favourable interest rates and terms. Prime mortgage-backed securities are the main type issued in Australia.

Charts 5: Prime mortgage-backed securities are the main type issued in Australia

Source: Bloomberg

Residential mortgage-backed securities are also independently assessed by agencies such as S&P, Moody’s and Fitch, that stress-test the overall pool of loans (which typically share similar characteristics, such as being prime or non-conforming loans) and then assign a credit rating for each tranche based on their position the capital structure.

A stable source of income with solid foundations

Extreme market volatility so far in 2025 has reinforced the appeal of securities that are tied to tangible assets, as these are perceived as stable and less susceptible to price fluctuations. Real estate has traditionally been seen as a store of value, and Australian home prices have a long history of price stability.

Since the first residential mortgage-backed security in 1986, the market has grown in maturity and demonstrated resilience to economic shocks. Notably, investors in rated Australian RMBS have historically never suffered principal losses.

Uncertainty on the geopolitical, inflationary and interest rate fronts has not dampened enthusiasm for Australian residential mortgage-backed securities, the popularity of which is testimony to the resilience of collateral performance through economic cycles, the agility of issuers to recalibrate when necessary, and investors’ appetite for relative value. The robust labour market in Australia is also supportive of stable RMBS performance, with low unemployment being one of the key factors that have kept arrears and delinquencies to modest levels.

Out of reach no more

Until now, the Australian residential mortgage-backed securities market has largely been available to institutional investors only. In superannuation and investment portfolios, exposure has primarily been via a sleeve within diversified fixed income strategies, rather than as a standalone investment. This is due to the complexity, lower liquidity, and specialist expertise required to manage residential mortgage-backed securities effectively.

Now, investors of all sizes can access a dedicated portfolio of AAA-rated Australian residential mortgage-backed securities via a single trade for the first time through the new VanEck Australian RMBS ETF (ASX: RMBS). RMBS listed on ASX last week offering investors a liquid investment opportunity with a yield uplift, commensurate with risks. AAA-rated residential mortgage-backed securities benefit from a diversified underlying mortgage pool and high payment seniority.

RMBS tracks the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index which only includes Australian dollar-denominated, residential mortgage-backed securities issued in Australia that hold a AAA rating based on an average of Moody’s, S&P and Fitch.

Key risks: An investment in the ETF carries risks associated with: securitisation market, housing market, trustee management, bond markets generally, interest rate movements, concentration, credit ratings, fund operations, liquidity and tracking an index. See the VanEck Australian RMBS ETF PDS and TMD for more details.

Source

Published: 27 April 2025

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange traded funds (Funds) trading on the ASX. This information is general in nature and not personal advice, it does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.

ICE is a registered trademark of ICE Data Indices, LLC or its affiliates. This trademark has been licensed, along with the ICE 0.5-3 Year AAA Large Cap Australian RMBS Index (“Index”) for use by VanEck in connection with RMBS (the “Product”). Neither VanEck nor the Product(s), as applicable, is sponsored, endorsed, sold or promoted by ICE Data Indices, LLC, its affiliates or its third party suppliers (“ICE Data and its Suppliers”). ICE DATA AND ITS SUPPLIERS MAKE NO REPRESENTATIONS OR WARRANTIES REGARDING THE ADVISABILITY OF INVESTING IN SECURITIES GENERALLY, IN THE PRODUCT(S) PARTICULARLY, OR THE ABILITY OF THE INDEX TO TRACK GENERAL MARKET PERFORMANCE. ICE DATA AND ITS THIRD PARTY SUPPLIERS ACCEPT NO LIABILITY IN CONNECTION WITH THE USE OF THE INDEX, INDEX DATA OR MARKS. See PDS for a full copy of the disclaimer.