China's consumer revolution

There has been much talk about the trade war between China and the US. While it has been said that in the US the consumer is king and the US consumer has been behind much of that nation’s growth, no such claims have been made about the Chinese consumer - yet.

While the US has around 330 million potential consumers, China has 4 times that many at almost 1.4 billion. China is an economy undergoing a profound transformation in which consumer-oriented sectors are gradually replacing heavy industry and low cost manufacturing as the country’s economic engines. As demographics shift, the Chinese consumer could be the economic defence in any ongoing trade dispute.

As China's economy undergoes a profound transformation, it is clear that increasingly wealthy consumers are behind much of the growth.

Traditionally economies like China have depended on financials, energy and materials. As GDP per capita has increased, domestic policy and reform has been focused on transitioning the economy to be consumption led. One of the forces behind this growth is an increasingly affluent and growing middle class.

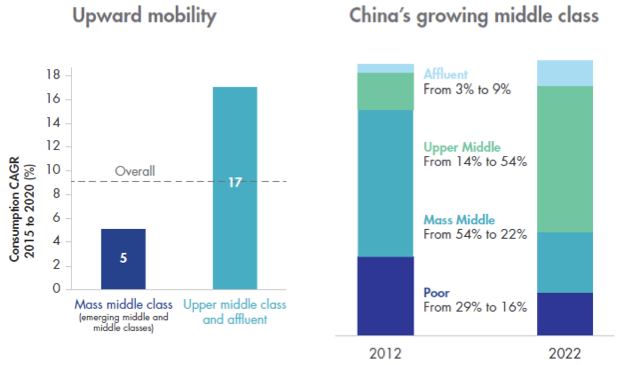

Source: BCG Analysis CAGR = compound annual growth rate (LHS) Emerging middle and middle classes include consumers whose annual household incomes range from $10,001 to $24,000; upper middle classes and affluent include consumers whose annual household incomes exceed $24,000. Source: McKinsey 2016 China Consumer Report (RHS)

Source: BCG Analysis CAGR = compound annual growth rate (LHS) Emerging middle and middle classes include consumers whose annual household incomes range from $10,001 to $24,000; upper middle classes and affluent include consumers whose annual household incomes exceed $24,000. Source: McKinsey 2016 China Consumer Report (RHS)

The bigger wallets of consumers are behind much of the change. Rapid urbanisation has led to a huge increase in consumption. Around 60% of China’s population now lives in urban areas, well up from just 16% in 1960.1The World Bank2projects that China’s urban population will rise to about one billion by 2030.

In the last 30 years, China’s record economic growth lifted half a billion people out of poverty.3So consumers have more money to spend. Moreover, many Chinese are funding their consumption from savings. But as they turn to credit, the outlook for spending is even better.

In the first quarter of 2018, domestic consumption contributed to 78% of China’s economic growth, indicating that it has become a new driving force of the economy.4As China’s National Development and Reform Commission puts it: “There is huge potential for consumption growth, as the economy transitions from a phase of rapid growth to a stage of high-quality development.”5

The earnings and profits of companies operating in China’s 'new economy' are rapidly expanding too, driven higher by this rapid economic growth. The nation is the world’s second largest economy after the US and is projected to be the largest by 2030.6

Moreover, Chinese President Xi Jinping has recently pledged to further open access to China’s economy, in a rebuke to US President Donald Trump’s administration which has heightened trade tensions with China.

Investment strategies targeted at this new economy may therefore offer Australians a opportunity to diversify their portfolios and potentially reap good investment returns.

Consumer revolution

Below is a summary of the main factors driving China’s consumer revolution.

- Urbanisation

The rapid urbanisation in China has driven a huge jump in consumption. According to a research paper from the OECD, Urbanisation and household consumption in China, moving up the ‘residential ladder’ to a Chinese urban household from a rural one, results in a substantial increase in consumption of almost 30%.7

Urbanisation brings about changes in consumption patterns. For instance, urbanites tend to spend more on education and leisure. More educated households, which are found in the cities, also tend to spend more on transport and communications.8

Moreover, as society urbanises, more households will have access to healthcare, the best resources of which are found in the biggest cities.9Older households too tend to spend more on healthcare and China’s population is ageing.10

- The wealth effect

In coming years, the emergence of the upper middle and rich classes will drive further changes in consumption as these households will demand more upmarket goods and services rather than the basics like food and clothing. Wealthier consumers will, for example, favour services such as education, travel, luxury goods and medical services.

We are already seeing upmarket European fashion brands such as Prada and Gucci opening up shops in China at a rapid rate, leading to headlines such as this: “ Chinese Shoppers Power Gucci’s Sales Growth.”11 Chinese luxury goods manufacturers are quickly following suit and launching their own luxury products.

- Greater consumer confidence

As China’s wealth has grown and employment opportunities have expanded, so too has the confidence of the consumer. In February 2018, the Chinese Government’s consumer confidence index was 124, about 17.9 points higher than the average since 2012.12That’s a real sign that the Chinese population is enjoying the fruits of greater incomes.

- Technology and innovation drives e-commerce

Technology has been a huge enabler of China’s economic advancement. One of the most revolutionary changes has been the astounding growth of e-commerce. China is now the world’s largest e-commerce market, accounting for more than 40% of the value of worldwide e-commerce transactions, up from less than 1% about a decade ago.13

The ongoing digitalisation of industries, developments in artificial intelligence, and the rising spending power of China’s emerging young consumers are underpinning e-commerce.

Online channels today account for around 16.6% of total retail sales, second only to the UK at 18%, according to data from marketing research firm Invesp. In contrast, online shopping currently accounts for about 9% of total retail sales in the US and just 6.7% in Japan, which once led the Asian technological revolution.

Source: https://www.invespcro.com/blog/global-online-retail-spending-statistics-and-trends/

Over the next five years, private online consumption is expected to surge at a compound annual growth rate of 20%, compared with 6% annual growth in offline retail sales, according to Boston Consulting Group.

- Mobile revolution

When the Chinese go shopping, they conduct 11 times more mobile payments than their US counterparts,14who are hesitant to abandon their plastic cards. Penetration among China’s internet users for mobile payments has grown rapidly from just 25% in 2013 to 68% in 2016.15As mobile shopping becomes more prominent, Chinese are likely to be consuming even more. Combined with greater incomes, the ease with which Chinese can buy goods and services is gaining momentum.

Investment opportunities grow

As the new economy’s technology, healthcare, consumer staples and consumer discretionary sectors grow in importance, companies in those sectors will have the potential to reap greater earnings and profits too. As a result, this is an important market for investors.

Many new economy companies are listed on mainland China's two main stock exchanges, the Shanghai and Shenzhen exchanges. Combined, those exchanges form the second largest share market in the world after the US. China A-shares, which are listed on these exchanges, are undervalued by historical standards against other global indices.

The difficulty for Australian investors wanting to invest in this growth opportunity is gaining access. Many of the Chinese companies in the new economy aren’t available via other countries’ exchanges and only trade on the mainland Shanghai and Shenzhen stock exchanges.

As a holder of a Renminbi Qualified Foreign Institutional Investor (RQFII) quota, VanEck can trade these shares and for the first time we are offering Australian investors a way to step into tomorrow’s prosperity today via an ETF on ASX.

The VanEck Vectors China New Economy ETF recently listed on the Australian Securities Exchange (ASX: CNEW). CNEW is an Australian first and enables Australian investors to access a diversified portfolio of China A-shares with the best growth prospects via a single trade on the ASX.

Investors can now easily access the potential for strong investment returns that these companies offer which is being brought about by the Chinese economic revolution.

IMPORTANT NOTICE – FOR USE BY FINANCIAL SERVICES PROFESSIONALS ONLY

This information is prepared in good faith by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as the responsible entity and issuer of VanEck Vectors China New Economy ETF (the Fund). This information is general in nature and not personal financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision investors should read the product disclosure statement and with the assistance of a financial adviser consider if it is appropriate for their circumstances. A copy of the PDS is available at www.vaneck.com.au or by calling 1300 68 38 37.

An investment in the Fund is subject to various risks that may have the effect of reducing the value of the Fund, resulting in a loss of capital invested and a lack of income from the Fund. Chinese securities have heightened risks compared to investing in the Australian market. These risks include currency risks from foreign exchange fluctuations, ASX trading time differences, foreign laws and regulations including taxation, potential difficulties in enforcing contractual obligations, changes in government policy, expropriation, economic conditions including international trade barriers, restrictions on foreign ownership, securities trading restrictions, restrictions on repatriation and restrictions on currency conversion. No member of the VanEck group guarantees the repayment of capital, the payment of income, performance, or any particular rate of return from the Fund.

1https://data.worldbank.org/indicator/SP.URB.TOTL.IN.ZS

2https://openknowledge.worldbank.org/handle/10986/18865

3https://openknowledge.worldbank.org/handle/10986/18865

4http://english.gov.cn/archive/statistics/2018/04/24/content_281476122954126.htm

5http://english.gov.cn/archive/statistics/2018/04/24/content_281476122954126.htm

6https://business.financialpost.com/news/economy/china-will-overtake-the-u-s-in-less-than-15-years-hsbc-says

7OECD Economics Department Working Papers, Urbanisation and household consumption in China (2017)

8OECD Economics Department Working Papers, Urbanisation and household consumption in China (2017)

9OECD Economics Department Working Papers, Urbanisation and household consumption in China (2017)

10Ibid.

11https://www.wsj.com/articles/gucci-reports-weakest-sales-growth-in-nearly-two-years-1540311855

12http://english.gov.cn/archive/statistics/2018/04/24/content_281476122954126.htmp

13https://www.mckinsey.com/featured-insights/china/chinas-digital-economy-a-leading-global-force

14https://www.mckinsey.com/featured-insights/china/chinas-digital-economy-a-leading-global-force

15https://www.mckinsey.com/~/media/mckinsey/featured%20insights/China/Chinas%20digital%20economy%20A%20leading%20global%20force/MGI-Chinas-digital-economy-A-leading-global-force.ashx

Published: 08 November 2018