Powered by Lonsec Investment Solutions

VanEck has partnered with Lonsec Investment Solutions Pty Ltd (Lonsec) to provide four low-cost model portfolios comprised entirely of exchange traded funds (ETFs). The model portfolios are designed to assist advisers and brokers to construct simple and diversified portfolios to help meet their clients’ investment objectives.

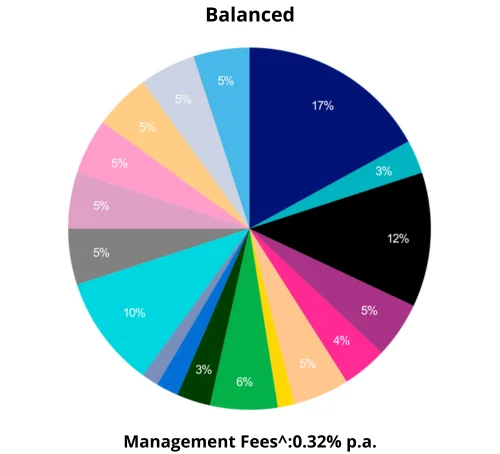

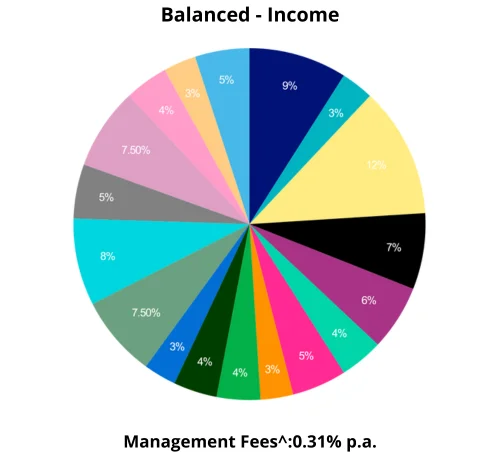

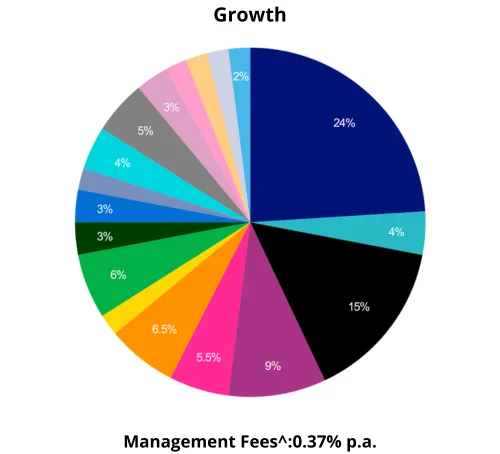

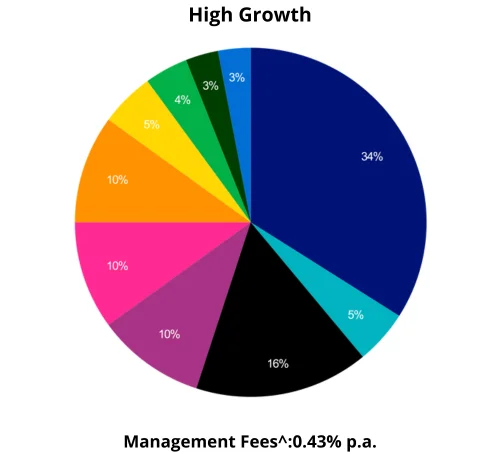

VanEck ETF Model Portfolios are powered by Lonsec drawing on their established research and portfolio construction expertise to provide recommended strategic asset allocations tailored to four risk/return profiles: Balanced, Balanced-Income, Growth and High Growth.

Lonsec employs a disciplined and proven portfolio construction process that leverages their strategic asset allocation framework. All ETFs included in the models must have a minimum ‘Lonsec Recommended rating’ and the model portfolio may include ETFs not issued by VanEck. Lonsec will be performing ongoing independent oversight of the models and will be providing quarterly performance reporting.

Each model portfolio provides broad market exposure across asset classes including Australian equities, global equities, property, infrastructure, Australian fixed income and international fixed income. Utilising simple low-cost ETF strategies delivers diversified exposure for considerably less cost than the average cost of Australian managed funds.

Using ETFs for Strategic Asset Allocation

Asset allocation is a critical element of any investment strategy. It forms the basis of a prudent investment policy and drives the bulk of an investor’s risk and return outcome.

VanEck and Lonsec believe that a diversified approach to portfolio construction is critical to achieving investment objectives. Each model portfolio is split between growth and defensive assets across a range of ETFs that Lonsec considers provide an appropriate exposure to the relevant asset class.

| Risk / return profile | Growth | Defensive |

| Balanced: | 60% | 40% |

| Balanced - Income: | 60% | 40% |

| Growth: | 80% | 20% |

| High growth: | 100% | 0% |

Australian Equities |

||

|

|

MVW | VanEck Australian Equal Weight ETF |

|

|

MVS | VanEck Small Companies Masters ETF |

|

|

VHY | Vanguard Australian Shares High Yield ETF |

| Global Equities | ||

|

|

QUAL | VanEck MSCI International Quality ETF |

|

|

VLUE | VanEck MSCI International Value ETF |

|

|

WDIV | SPDR S&P Global Dividend Fund |

|

|

QSML | VanEck MSCI International Small Companies Quality ETF |

|

|

EMKT | VanEck MSCI Multifactor Emerging Markets Equity ETF |

|

|

GDX | VanEck Gold Miners ETF |

Alternatives |

||

|

|

NUGG | VanEck Gold Bullion ETF |

Property & Infrastructure |

||

|

|

IFRA | VanEck FTSE Global Infrastructure (AUD Hedged) ETF |

|

|

MVA | VanEck Australian property ETF |

|

|

REIT | VanEck FTSE International Property (AUD Hedged) ETF |

| Fixed Interest | ||

|

|

PLUS | VanEck Australian Corporate Bond Plus ETF |

|

|

5GOV | VanEck 5-10 Year Australian Government Bond ETF |

|

|

SUBD | VanEck Australian Subordinated Debt ETF |

|

|

TBIL | VanEck 1-3 Month US Treasury Bond ETF |

|

|

VIF | Vanguard International Fixed Interest Index (Hedged) ETF |

|

|

FLOT | VanEck Australian Floating Rate ETF |

|

|

XGOV | VanEck 10+ Year Australian Government Bond ETF |

|

|

BILL | iShares Core Cash ETF |

Disclaimer

^Management costs for are estimates as of 31 March 2025 calculated as a weighted average of the management costs disclosed in the PDSs for the underlying ETFs in the model portfolio.