Invest in Apples not Oranges

Apple Inc. is the company behind the phones, computers, watches, glasses, health devices, online storage, payment systems, books and music that you own, or will own in the near future. What you don’t own, but could own in the near future...

Apple Inc. is the company behind the phones, computers, watches, glasses, health devices, online storage, payment systems, books and music that you own, or will own in the near future.

What you don’t own, but could own in the near future is shares in Apple. Even if you are part of the small band of non-conformists who shun its products, there are good reasons to consider its shares.

Apple's most recent Annual Report showed an annual profit of US$39.5 billion on equity of US$111.5 billion. This represents a return on equity (ROE) of more than 35%. The company introduced a modest amount of debt to its balance sheet for the first time in 2013 and has been reducing its equity in response. The Report shows a debt-to-equity ratio of only 0.32.

The data for the most recent five years in US dollars is:

| 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|

| Profit ($b) | 14,013 | 25,922 | 41,733 | 37,037 | 39,510 |

| Earn./Sh. (c) | 2.16 | 3.95 | 6.31 | 5.68 | 6.45 |

| Equity ($b) | 47,791 | 76,615 | 118,210 | 123,549 | 111,547 |

| Debt ($b) | 0 | 0 | 0 | 16,960 | 35,295 |

| ROE | 29.3% | 33.8% | 35.3% | 30.0% | 35.4% |

| Debt/Equity | 0.00 | 0.00 | 0.00 | 0.14 | 0.32 |

Source: Market Vectors, Apple Annual Report, 2014

Three things stand out in this data:

- the return-on-equity is high;

- the growth in earnings per share over the five years has been quite steady; and

- the debt-to-equity ratio is low.

Apple's recent financial results are impressive but as an investor you are concerned with the future returns if you buy its shares now.

There may be a link between the past data and future returns.

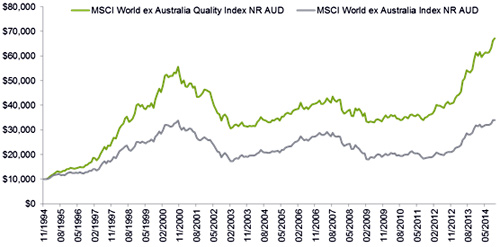

MSCI, the world's largest index provider, has created the MSCI World ex Australia Quality Index (Quality Index) which takes a subset of the highest quality companies from their developed markets index, the MSCI World ex Australia Index (Parent Index).

MSCI analyses the 1,500+ companies in the Parent Index and selects only the top 300 with the best combined results in high ROE, low earnings variability and low financial leverage for inclusion in its Quality Index. MSCI updates the Quality Index every six months.

Comparing the Quality Index to its larger Parent Index back to 1994 demonstrates significant historical outperformance of the Quality Index over this period.

Source: Bloomberg, iRate, as at 31 October, 2014. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude costs associated with investing in the ETF. You cannot invest directly in an index. The above performance information is not a reliable indicator of current or future performance of the Indices or ETF, which may be lower or higher.

Historically, investing in companies at the time they showed the characteristics that Apple is currently showing, has delivered significant outperformance to the broader market. Apple is just one of the companies identified by MSCI as having the fundamental financial characteristics that justify inclusion in its Quality Index.

This methodology would have been well-suited as a core allocation to international equities in an investor’s portfolio. It would have been a successful way to get the diversification into international equities that a balanced portfolio requires.

An Australian investor could not however have built this portfolio themselves. It would have been too hard to know all the companies in the developed world, to analyse their performance and to execute the trades.

The solution is now available. You can now make the 300 quality companies identified by MSCI part of your model portfolio via a single trade on the ASX. The Fund is called the Market Vectors MSCI World ex Australia Quality ETF with the trading code: QUAL. QUAL replicates MSCI’s Quality Index which currently includes Apple and similar companies such as Google, Microsoft, Rolls Royce, Marks & Spencer and Singapore Exchange.

With an annual management fee of 0.75%, QUAL provides the potential to outperform broader international equity ETFs, at a lower cost than comparable actively managed funds.

Using QUAL you can now own Apple shares and track QUAL's price on your iPhone or iPad while listening to music you downloaded from iTunes. You might even be doing all this while you wait in line for your new Apple Watch.

IMPORTANT NOTICE: This information is issued by Market Vectors Investments Limited ABN 22 146 596 116 AFSL 416755 as responsible entity ('MVI') of the Market Vectors MSCI World ex Australia Quality ETF ('QUAL'). MVI is a wholly owned subsidiary of Van Eck Associates Corporation based in New York ('Van Eck Global').

This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation nor needs ('circumstances'). Before making an investment decision in relation to QUAL, you should read the product disclosure statement ('PDS') and with the assistance of a financial adviser consider if it is appropriate for your circumstances. The PDS is available at www.marketvectors.com.au or by calling 1300 MV ETFs (1300 68 3837).

QUAL is subject to investment risk, including possible delays in repayment and loss of capital invested. Past performance is not a reliable indicator of current or future performance. No member of the Van Eck Global group of companies guarantees the repayment of capital, the performance, or any particular rate of return from the Fund.

QUAL is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to QUAL or the Reference Index. The PDS contains a more detailed description of the limited relationship MSCI has with MVI and QUAL.

Market Vectors® and Van Eck® are registered trademarks of Van Eck Global.

© 2014 Van Eck Global. All rights reserved.

Published: 09 August 2018