ETF investors eye buying opportunities in 2024

December 2023

Despite volatility dominating both 2023 and many portfolios, VanEck’s latest annual investor survey has revealed Australian investors are eyeing up opportunities in the first half of 2024, with almost 60% of investors either planning on increasing their allocation to ETFs or making their first investment in ETFs in the next 6 months. One in two investors are planning on increasing their allocation to ETFs within their SMSF portfolio.

According to the survey conducted in November 2023, 65% of respondents are planning to invest in Australian shares next year, while 50% are planning to invest in international shares. Only 14% said they do not plan on investing at all next year. These results are almost identical to how investors planned their portfolios the previous year and show appetite has not waned, despite continued uncertainty across markets.

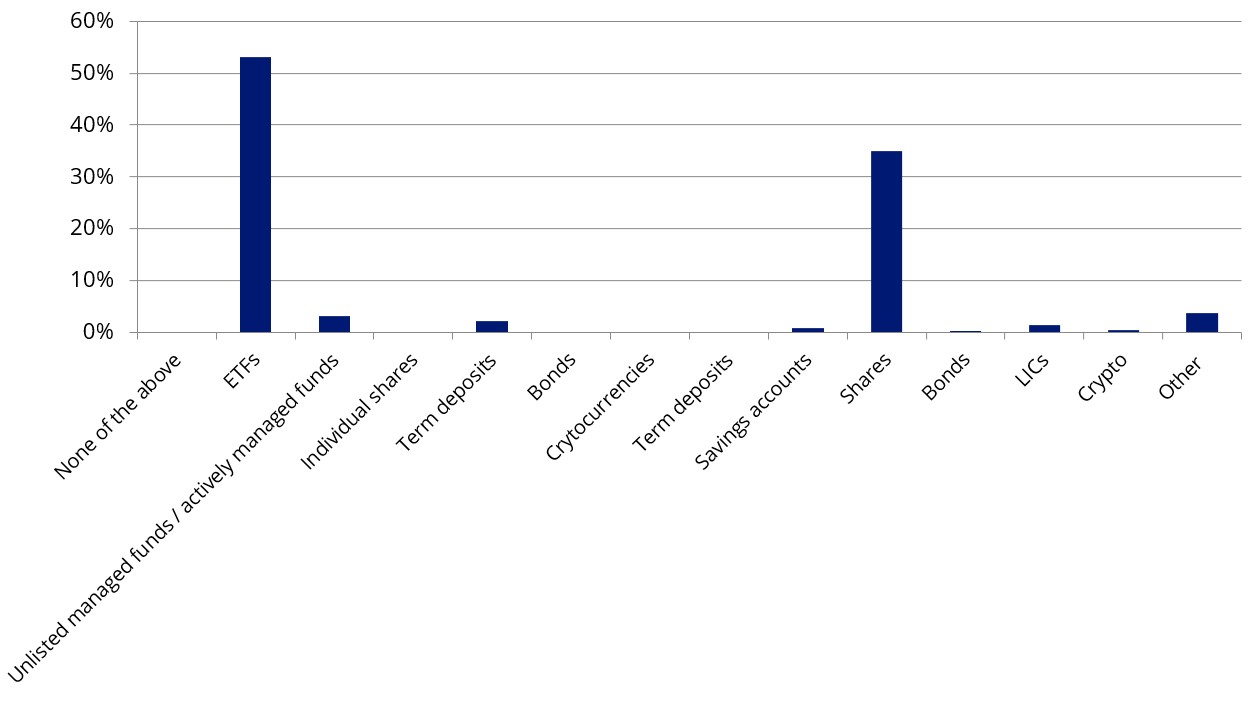

The 2023 VanEck Australian Investor Survey also showed that ETFs are by far the most popular investment vehicle, with the lion’s share of investors preferring ETFs. Only 3% of investors selected unlisted/actively managed funds and less than 2% selected LICs as their favourite. 84% of investors said they would recommend ETFs to other investors.

What is your favourite type of investment product?

Source: VanEck, VanEck Australian Investor Survey 2023.

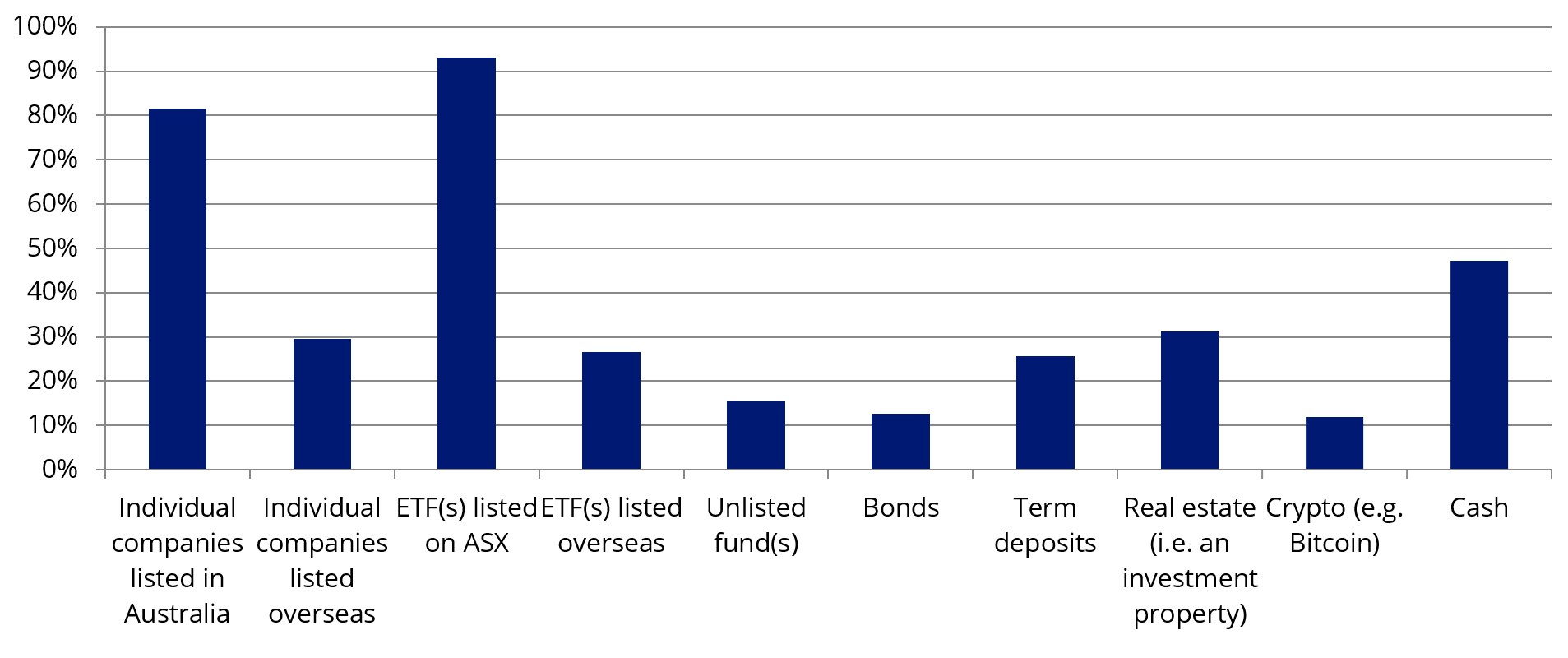

Similarly, ETFs rank as the most popular investment vehicle in investors’ current portfolios, with over 90% of respondents invested in at least one ETF.

What are you currently invested in?

Source: VanEck, VanEck Australian Investor Survey 2023.

Technology and healthcare are the winning sectors for 2024, according to investors. Almost 50% of respondents said they were considering investing in the tech sector next year, and almost 40% are considering investing in healthcare companies. Across all age groups except Baby Boomers (those 60 years and older), technology was the most popular, followed by healthcare and then resources. Conversely, resources was the most favoured sector among boomers, followed by healthcare, and technology a close third. The vast majority (74%) of respondents said they would not be looking to invest in ESG funds in 2024.

VanEck Asia Pacific CEO and Managing Director, Arian Neiron says: “This year has further shown the resilience and popularity of ETFs, as well as the decline in actively managed funds. While the economic turbulence of 2023 is likely to continue into 2024, it’s clear that investors are still seeking opportunities and are confident in the long-term benefits of investing in ETFs.”

“We see the ETF market in Australia reaching $180 billion by the end of 2024,” said Neiron.

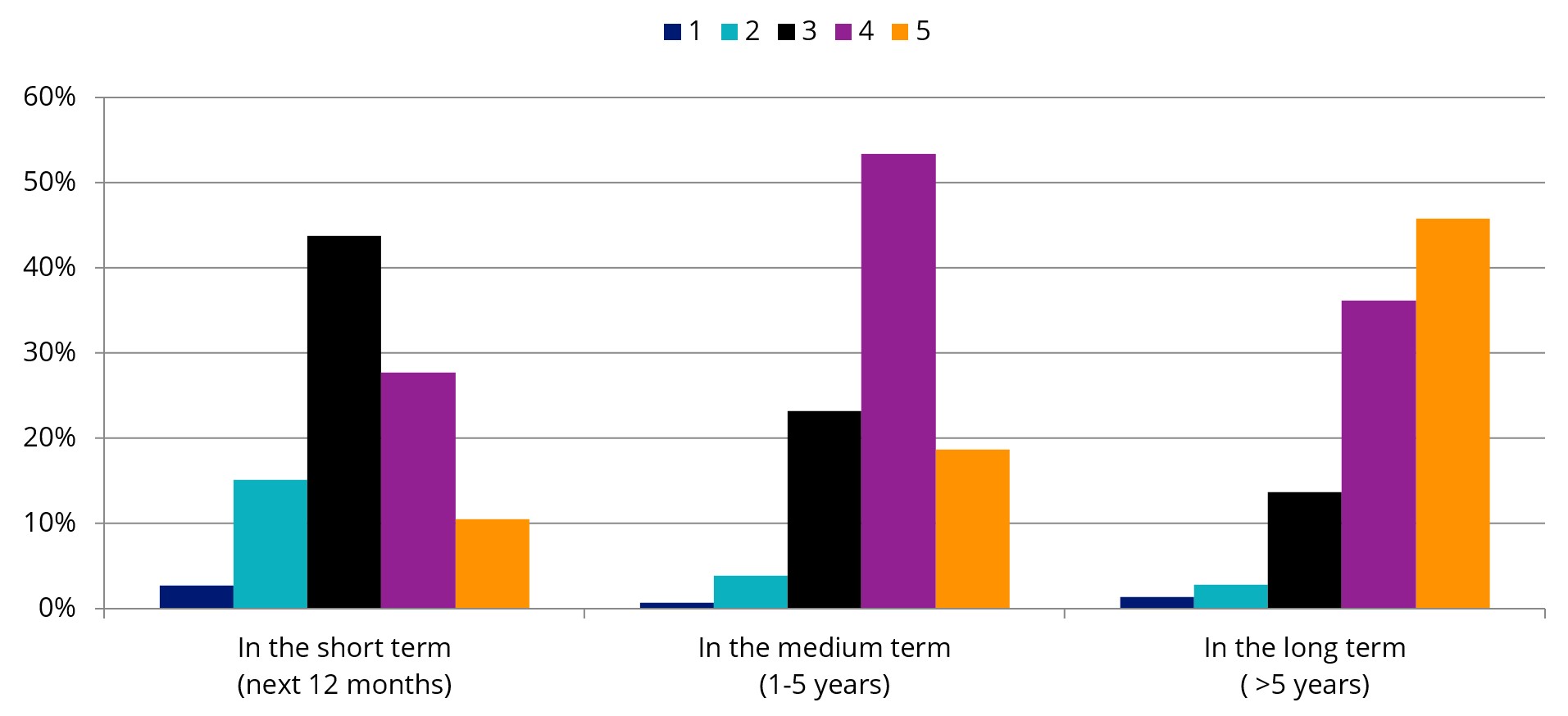

On a scale of 1 (not confident) to 5 (very confident), how do you feel about your current investment portfolio?

Source: VanEck, VanEck Australian Investor Survey 2023.

Overall investor confidence looks to be significantly improving over the 1- to 5-year horizon with more than 60% of respondents feeling confident about their portfolios over the medium term. Confidence increased further when considering a long-term outlook with more than 80% of investors feeling confident about their portfolios on a 5+ years basis.

Any views expressed are opinions of the author at the time of writing and is not a recommendation to act. VanEck Investments Limited (ACN 146 596 116 AFSL 416755) (VanEck) is the issuer and responsible entity of all VanEck exchange trades funds (Funds) listed on the ASX. This is general advice only and does not take into account any person’s financial objectives, situation or needs. The product disclosure statement (PDS) and the target market determination (TMD) for all Funds are available at vaneck.com.au. You should consider whether or not an investment in any Fund is appropriate for you. Investments in a Fund involve risks associated with financial markets. These risks vary depending on a Fund’s investment objective. Refer to the applicable PDS and TMD for more details on risks. Investment returns and capital are not guaranteed.