Why it is unwise to follow 'The Wisdom Of Crowds' in investing

The stock market, in ‘The Wisdom of Crowds’ by James Surowiecki, is highlighted as one of the few instances of ‘the many not being smarter than the few.’ This anomaly goes a long way to explain the failings of most Australian equity portfolios.

The central theme of ‘The Wisdom of Crowds’ is that the judgements of many are better than the judgements of the few. Early in his book Surowiecki cites 19th century scientist Francis Galton’s observation at a fair to illustrate the theme of his book. Galton observed a guessing competition in which participants guessed the weight of an ox. Not one of the 800-odd entrants guessed the correct weight, but when Galton calculated the average of all the guesses the result was that the crowd had ‘guessed’ within one pound of the correct weight. The average ‘guess’ of the crowd was better than the guess of each individual. This is the wisdom of crowds and Surowiecki’s book highlights examples of this including the accuracy of betting markets and the impressive strike rate of the studio audience in ‘Who Wants to be a Millionaire’. Surowiecki’s book identifies the conditions for a crowd to be wise and instances when crowds are wrong because these conditions are missing. The stock market is one example of an unwise crowd.

Among the reasons that the stock market is not a wise crowd are:

1. That the market overreacts to news; and

2. The uniform resources used and the similar backgrounds, education and goals of investors resulting in similar conclusions and unconventional thinking being admonished.

In regards to too much information, Surowiecki highlights the works of economists Jeffery Busse and T Clifton Green, psychologist Paul Andreassen and financial analyst Jack Traynor. Busse and Green’s work noted a correlation between the momentum of stock prices and CNBC coverage. Andreassen was able to illustrate that news reports tend by their nature to overplay the importance of a piece of information and in turn investors put too much weight into that.

Traynor illustrated that this type of information could skew the collective wisdom of a group leading it to be less accurate. In Traynor’s experiment a group of subjects were asked to guess the number of beans in a jar. Approximating Galton’s ox observation the average of the group was remarkably accurate. The group was asked to guess again but was told to consider the gap at the top of the jar. The average was wildly different as the subjects put too much weight into that information and it skewed the results of the group in a negative way. “The problem of putting too much weight on a single piece of information is compounded when everyone in the market is getting that information.” (Surowiecki, p 254)

Surowiecki posits that positive and negative news is exacerbated in the stock market as investors do not make decisions independently and there is very little diverse thinking. Diversity and independence are needed for crowds to be wise and each participant’s starting point and approach to the problem needs to be different. In equity investing, most professional investors begin with the same starting point. They apply the same management and economic theories and the same techniques. They observe each other’s behaviour. Information is assessed by like-minded individuals with comparable goals using similar systems while reading the same news articles and the same analyst briefings. This result is behaviour akin to that of a herd, as opposed to a wise crowd of independent thinkers and decision makers.

In Australia this herd mentality has led to many professional investors underperforming the S&P/ASX 200 index. In the most recent SPIVA® Australia scorecard only 32.8% of Australian equity funds managed to beat the benchmark over five years (to December 2015).

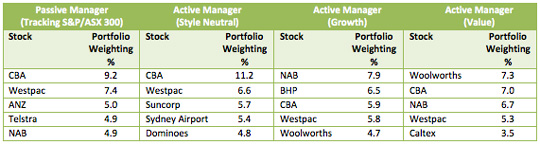

A review of the holdings of a sample of the largest fund managers shows that they continue to act like a herd with most managers holding similar names in similar weights.

Top 5 holdings of Passive Manager and select Active Managers

Source: VanEck, Morningstar Direct, as at 29 February 2016

The result of following the herd is getting the herd’s ‘unwise’ outcome. Over the long term Australian equity fund managers generally underperform the benchmark. To outperform you need to do it differently.

There is a simple strategy that ignores the herd and it is outperforming. It is agnostic to the size of the stock, factors, news or analyst recommendations. It is equal weight investing which, as the name implies, weights all of its constituents equally. Diverse, independent groups such as scientists, academics, index providers and contrarian investors support equal weight investing.

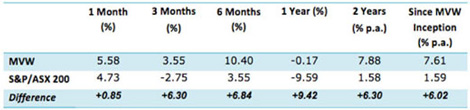

Market Vectors Australian Equal Weight ETF (ASX code: MVW) is the first and only equal weight Australian equity ETF available on ASX. MVW equally weights the largest and most liquid ASX-listed companies and has outperformed the S&P/ASX 200 Accumulation Index by 6.30% p.a. over two years returning 7.88% p.a. compared to 1.58% p.a.

Performance of MVW to 31 March 2016

*Inception date is 4 March 2014

Source: Morningstar Direct, as at 31 March 2016. Results are calculated daily to the last business day of the month and assume immediate reinvestment of all dividends. MVW results are net of management costs but do not include brokerage costs of investing in MVW. Past performance is not a reliable indicator of future performance

If you would like more information on MVW please contact our ETF specialists on 02 8038 3300 or email us at info@marketvectors.com.au

IMPORTANT NOTICE: This information is issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’) as responsible entity and issuer of the Market Vectors Australian Equal Weight ETF (‘Fund’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation nor needs. Before making an investment decision in relation to the Fund, you should read the PDS and with the assistance of a financial adviser and consider if it is appropriate for your circumstances. The PDS is available at www.vaneck.com.au or by calling 1300 68 3837. The Fund is subject to investment risk, including possible loss of capital invested. Past performance is not a reliable indicator of future performance. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the payment of income, the performance, or any particular rate of return from the Fund.

Published: 09 August 2018